The Path Forward After the Tariff Shock

April 7, 2025 By Sage Advisory

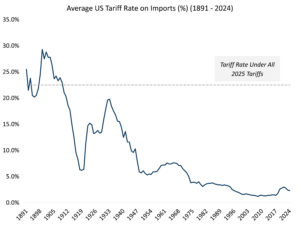

Last week President Trump announced tariffs on nearly all US trading partners, a move that far exceeded the most pessimistic expectations of market participants. The substantial amount and the haphazard manner of the announcement caught markets off guard. While tariffs were anticipated due to presidential campaign rhetoric and Trump’s intense focus on addressing the US trade deficit, the actual announcements were more aggressive than anticipated and markets reacted accordingly. The tariffs, calculated as a percentage of the 2024 trade deficits with the US, resulted in an effective rate of approximately 22.5% across the board, a significant increase from the 2.5% rate in 2024.

Source: US International Trade Commission, Yale Budget Lab

While the historically high tariff rate is intended to be a starting point for negotiations and is expected to decrease, the high initial rate means that the final negotiated levies will likely be higher than anticipated. These tariffs are set to be implemented almost immediately, giving little time for partners to negotiate before they take effect. Given that bilateral negotiations with affected trading partners could take months, the elevated tariffs could remain in place for an extended period. Additionally, the risk of retaliation and escalation from trading partners is significant, as evidenced by China imposing retaliatory tariffs less than 24 hours after the Liberation Day tariffs were announced.

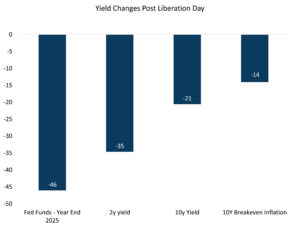

Markets reacted sharply to the unexpected announcement, with the US equity market experiencing its largest two-day decline since 1940. This led to a flight to quality, resulting in a rally in rates and widening spreads.

Treasury yields dropped sharply after the announcement. Tariffs typically lead to higher prices for companies and consumers, but the immediate market reaction was to anticipate a near-term drop in aggregate demand and a slowdown. Inflation expectations decreased, with the TIPS breakeven inflation rate falling by 14 basis points, indicating the market’s expectation of a negative growth shock in the near-term. The FOMC is now expected to cut rates by at least 100 basis points this year. In his remarks on April 4th, Jerome Powell indicated it was too early to gauge the appropriate monetary policy stance, while expressing concern about both rising prices and falling growth.

Source: Sage, Bloomberg

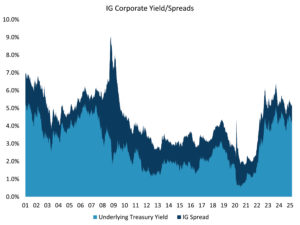

Credit spreads widened from their historically tight levels, with investment grade corporates increasing by 16 basis points to 1.09%, and high-yield bonds rising by 93 basis points to 4.27% over treasuries. Although credit markets are experiencing their worst repricing since 2024, spreads are still not at crisis or recessionary levels and remain on the lower end of historic averages. While there is potential for spreads to widen further, especially with tariffs posing a real threat to economic expansion, we believe fixed income inflows should remain strong. “Yield buyers” are likely to take advantage of the high yields amid high equity volatility and substantial money market assets facing lower forward yields. Any sharp increases in yield should result in solid demand, particularly in IG bonds.

Source: Sage, Bloomberg

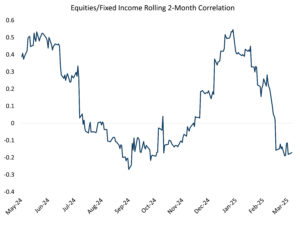

Shrinking economic activity and heightened geopolitical concerns should see fixed income remain well supported. In recent weeks, fears of slowing growth compounded by the negative shocks from potential tariffs and federal job and spending cuts resulted in a shift in the stock/bond correlation structure, which saw high-quality fixed income serve as a diversifier to risky assets after years of moving in tandem with equities. Since the last update in early March, correlations have continued to fall precipitously and are now on par with the negative growth scare in the fall of 2024. We expect this relationship to continue to revert as the risk of a deeper slowdown grows.

Source: Sage, Bloomberg

The path forward contains more questions than answers at this point. Could the current wave of tariffs push the economy into a recession? Despite the negative market and public reactions, even if tariffs don’t directly cause a recession, market stress could undermine confidence, leading to a deeper slowdown — a phenomenon George Soros famously termed “reflexivity.” It’s too early to make a definitive call, as economic data still indicate solid expansion, with recent job figures exceeding expectations. Additionally, the US private sector is healthy, with household balance sheets much cleaner than in prior debt crises. However, the decline in confidence indicators and the buildup in investment balances in recent years warrant caution.

Tariffs will result in inflation across the global economy, as it is effectively a tax on production. Broadly rising prices results in lower demand and a deeper slowdown in a “stagflationary” dynamic. In that scenario, the Fed will face a dilemma in its monetary policy calibration on whether to raise rates to combat rising prices or lower them to stimulate demand. We believe the Fed will continue to lean toward a dovish approach, prioritizing the demand side of the equation (lower consumption and employment) over the supply side (tariffs), which, despite tariffs being significantly high, they represent a one-time shock to prices.

Lastly, the political factor remains the largest unknown. What is the administration’s “pain tolerance” for the economy and markets and its appetite for negotiation? Also, the other major leg of Trump’s economic agenda, which is the renewal of the 2017 tax cuts along with any spending cuts, will play a big role in the trajectory of the economy and certainly market sentiment. We mentioned in a prior post that we believe tariffs will be a key fixture in trade negotiations, as a tool to extract better trade terms. Unfortunately, the delicate balance of negotiations versus a damaging trade war seems to have tipped in favor of the latter.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.