The 2020 Presidential Election and Markets – 5 Things Investors Need to Know

October 2, 2020 By Sage Advisory

by Rob Williams, Director of Research

We expect the continued economic recovery to be a driver of market returns overall and putting the uncertainty of elections behind us will be positive for risk assets such as equities. In the meantime, as we enter the height of election season, investors should consider how the following factors will affect markets.

1) Expect a tight race and continued volatility. Biden maintains a lead over Trump in the voting polls, but the lead has shrunk as the economic recovery gained momentum and markets moved higher.

Source: Bloomberg

Trump’s polling gap is highly dependent on Covid-19 cases. Recent market volatility and an uptick in new cases is likely to keep Trump trailing into the election, but close enough to keep results highly uncertain.

Source: Bloomberg

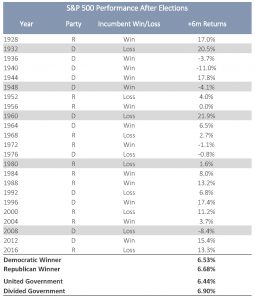

2) Historical data is a mixed bag. Historical election and market return data tells us that immediate post-election market returns have not favored either party; both parties have had strong positive and negative return regimes over both short and longer periods. While the incumbent president has typically had the advantage, 13 vs. 10 wins, this is not so during recessions, where the incumbent has lost 4 out of 5 times.

Source: Bloomberg

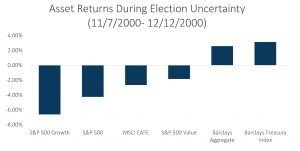

3) Contested results will cause market volatility. A contested election/delayed results is something investors should be considering and would likely result in at least a temporary risk-off scenario. The 2000 election is the nearest example we have of a delayed result, when the Supreme Court ultimately halted recounts and declared a winner. The result of the uncertainty was lower interest rates and weaker equities, with performance favoring international, value-oriented equities and longer-duration fixed income.

Source: Bloomberg

4) Trade policy will be impactful and doesn’t depend on either party controlling Congress. The handling of trade policy will be one of the key differences between candidates and doesn’t require a shift in Congress to be implemented. Harsh rhetoric and tariffs during the China/U.S. trade war weighed on international returns, especially China and emerging market Asia. Status quo results may continue to favor the U.S., while a Biden victory could bolster relative international returns.

Source: Bloomberg

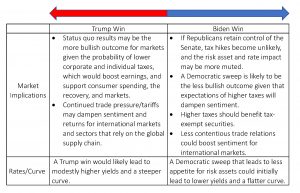

5) Both parties will focus on pro-growth policies, and the Fed will be the more important driver of interest rates. The following table provides color on how markets would respond depending on the winning candidate.

Source: Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.