The investment objective of this strategy is to minimize downside risk in any environment and maintain consistent quarterly total returns over a short term 1-3 year investment horizon.

Tag: Taxable Fixed Income

Black Swans of the Same Feather – Sage Commentary on Recent Market Volatility

The market moves in recent weeks have been nothing short of unprecedented. We seem to be experiencing multiple rare and unpredictable events simultaneously. The following is a recap of key events and our observations thus far.

A recap of last week through Monday, March 9:

- COVID-19 concerns have grown given its spread to an increasing number of countries. The disease has now reached more than half of the countries in the world, including the U.S. This has been a major concern, and markets have priced in a hit to economic growth both from private sector demand and more uniquely, supply-side shock, as supply-chain disruptions in Asia and now the U.S. will result in a further hit to global growth. In its most recent report, the OECD revised its 2020 global growth rate assumption down to 2.4% from an already low 3% given concerns around COVID-19. The rate could fall as low as 1.5%, according to the OECD’s outlook.

- A strong policy stimulus response was expected, and the Fed made the first move, with an emergency 50 bps rate cut on March 3. However, given that the current situation largely involves an unpredictable viral outbreak that is truly an external shock, lowering the cost of money did not have the same effect as in prior slowdowns since the 2008 crisis. In the coming weeks, the world’s major central banks and governments are expected to inject additional monetary and fiscal stimulus into the economy to combat any potential slowdown. The ECB is expected to ease policy further, either by cutting rates and/or making asset purchases on March 12, and the Fed is expected to follow suit with further rate cuts on March 18. On the fiscal side, affected countries could provide fiscal stimulus to their respective private sectors through the form of tax cuts or direct relief to affected industries – similar to what China has done over the past month for its domestic business sector.

- In addition to the COVID-19 shock, tensions between Russia and Saudi Arabia have escalated into an all-out oil price war. In response to a breakdown in OPEC/Russia talks last week, on Saturday, Saudi Arabia announced massive discounts to its official oil selling prices and indicated that it was increasing production above the typical 10 million barrels per day. The fear of an oil price war resulted in a 25% selloff in crude oil during yesterday’s trading session – the second worst day for WTI crude on record. The selloff sent shockwaves through global markets, as any commodity-linked asset class or sector priced in an additional hit to growth on top of slowing activity from COVID-19.

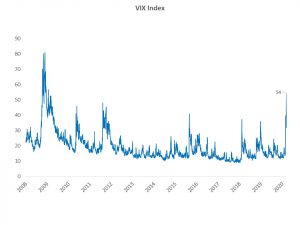

- These events occurred in the context of a market with extremely thin liquidity. Wider bid-ask spreads across all asset classes have amplified market volatility with several extreme +3% up and down days. Currently, the VIX index is trading at 55, the highest at any time since the 2007/2008 crisis.

Observations:

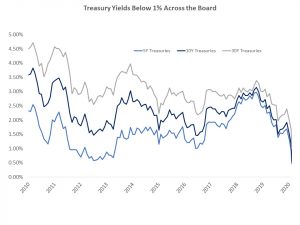

- The collapse of Treasury yields – Treasury yields have collapsed to all-time lows as investors continue to flock to safe havens. U.S. Treasury markets are not just pricing in further Fed action, they are pricing in a total “Japanification” of the U.S. economy with long-duration yields trading well below 1% at the start of this week.

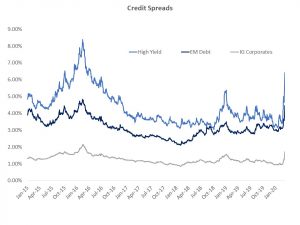

- Widening credit spreads – Credit spreads have widened past 4Q 2018 to near 2016 levels, with the speed of the move catching investors off guard. U.S. credit markets, which before March had been resilient against virus fears, have repriced to reflect a significant economic slowdown over the balance of 2020. Currently, the U.S. high yield sector offers an all-in yield at near 8%, which could prove to be an interesting opportunity if market volatility begins to settle down as a result of positive Covid-19 breakthroughs, government policy actions, and increased investor confidence.

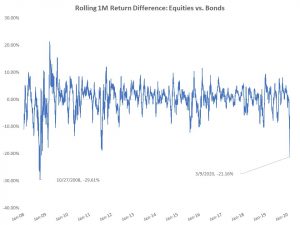

- Equity performance vs. bonds – The recent relative return of global equities versus bonds has no precedent outside of the financial crisis, since right after the collapse of Lehman Brothers and AIG. The chart below shows the 1-month relative return of the MSCI ACWI vs. the Bloomberg Global Aggregate Index, which stands at -21%.

The Market is Pricing in a Recession – The Question is: How Deep?

At Sage, we’ve maintained a relatively low level of risk across most of our strategies and remain opportunistic. A full-scale risk-off positioning often provides an opportunity in dislocated areas of the market, but we believe it’s too early to “buy the dip” here. Markets are in “no-man’s land” in some respect, driven by a tremendous amount of uncertainty and fear.

The scenario in which COVID-19 disruption devolves into a global recession is now reflected in market pricing. The question now is how deep is it expected to be? Policymakers will respond in the coming days and weeks with monetary and fiscal stimulus, but the nature of those policies will have to somehow address the threat to the economy that is now fourfold: COVID-19 demand/supply chain shock, an oil price war, credit stress, and a lack of trading liquidity. We await that response, along with any new details, and will continue to keep you updated as this unprecedented situation develops.

Going Forward: Heightened Market Surveillance & Identifying Value Across Asset Classes

- The Sage investment team is deeply experienced and has worked together through multiple cycles, including several periods of economic and market stress. During uncertain times, the structure and experience of our team has proven to be an advantage for our clients.

- We approach this environment with patience and diligence. Within our fixed income portfolios, our duration positioning has become more defensive in anticipation of more normalized levels of interest rates. Furthermore, a normalization of market risk has the potential to steepen the yield curve in concert with further rate cuts from the Fed. Within credit, we have maintained a relatively conservative posture, which has helped to mitigate downside risk during this correction. We continue to be selective in our credit exposure, avoiding issuers that we deem to be vulnerable to near-term downgrade pressures. In early February, we lowered equity sensitivities within our multi-asset class strategies, which allows us to be opportunistic in the case that conditions improve and/or attractive valuations present themselves.

- For more information about specific Sage strategies, please reach out to your client service team at 512-327-5530.

* Source on all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

The Coronavirus and Sage’s Fixed Income Exposure

February 6, 2020 — The WHO has called the coronavirus crisis outbreak a “public health emergency of international concern.” This declaration has implications for the entire world economy, but certain sectors will be affected more than others. Transportation, Energy, and Basic Materials are most likely to be adversely impacted by a large decrease in demand for travel, fuel, and raw materials in the Asia-Pacific region. In light of this, we examined the exposure in our fixed income portfolios to a potential fallout from the spread of the virus.

Five Key Themes That Will Drive Markets in 2020

This presentation recaps returns for 2019 and provides Sage’s market outlook, including 5 key themes for 2020.

Auto Loan Losses: Navigating Through the Noise

by Seth Henry

Over the last few quarters, there have been numerous news headlines noting the rise in auto loan delinquencies. The headlines tell only part of the story, however, as many of the losses can be attributed to subprime auto loans, which comprise roughly 40% of the auto loan market.

Over the past decade, losses on automobile asset-backed securities (ABS) had actually trended downward and reached historic lows. This is due in part to the strong financial position of the American consumer. A decade of historically low rates combined with very low unemployment helped to keep the consumer in a stable environment and auto loan defaults relatively low. While it is true that delinquencies and losses have increased, this is due primarily to losses in the subprime portion of the auto loan market, which is $55 billion of the $140 billion market. Specifically, delinquencies and losses have increased for subprime issuers who have a poor track record for underwriting and managing risk.

While current losses on prime auto loans are higher than their historical lows (0.56% vs 0.30%), they are still very low and well within expectations.

Over the last five years, smaller-scale (non-benchmark) subprime issuers have seen losses increase from 7.60% to 9.90%, a much larger increase that weighs on the sector as a whole.

Despite subprime auto weakness, Sage believes that prime auto borrowers are in a healthy position and do not pose a systemic risk. Given the strong job market, consumer ABS is still a healthy sector with a compelling risk-reward value. The sector is largely AAA-rated, and a great alternative to other high-quality, lower-yielding assets.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Bonds are Better, Part 2! Expanded Allocation Strategies

January 1, 2009 — Over the last couple months market strategists, money managers and more recently the media have been highlighting the attractive yields and historically wide yield spreads over Treasuries that have been available in high-grade corporate bonds. Indeed, our most recent Special Report to clients in November titled “Bonds are Better”, highlighted the relative attractiveness of bonds, specifically high grade credit vs. stocks. In December corporate bonds realized some of this upside potential with corporate yields, based on the Barclays High-Grade Bond Index, falling from over 8.5% to 7.5%, netting investors a 6.5% total return for the month.

Bonds are Better! The Right Tactical Choice for 2009

November 1, 2008 — Investing during the last several weeks within an environment of rapidly declining asset values and record volatility has been more about damage control than implementing a pro-active strategy. Given the extent of recent market losses, most asset allocations have seen sweeping, dramatic changes and as a result investors are now faced with difficult portfolio rebalancing and tactical investment positioning decisions. While we support the investment notion of employing a periodic rebalancing policy for strategic allocations, we would caution against an aggressive move back into equities at this time. Even given the magnitude of the sell-off across the global equity markets, when one weighs the macro environment, relative asset valuations and the probable upside and downside market scenarios, we believe a stronger case can be made for significantly enlarging allocations to the fixed income sector, especially high-grade credit, for better returns versus equities over the next six to twelve months.