This presentation recaps returns for 2019 and provides Sage’s market outlook, including 5 key themes for 2020.

Tag: Tactical Fixed Income

Notes from the Desk: 3 Reasons Now is the Time to Sell High-Yield

by Ryan O’Malley, Fixed Income Portfolio Strategist

In recent weeks, Sage has become more cautious on lower-quality corporate bonds. Our caution is based on the following signals.

1. Abnormal Performance – High-yield bonds have performed well on an absolute-return basis this year, returning nearly 12% in 2019. Years of double-digit returns for high yield are rare and are typically followed by much weaker returns the following calendar year.

2. Relative Value – High-yield bonds have dramatically outperformed investment grade corporate debt this year, and particularly in the past few months. The spread premium paid by high-yield bonds compared to investment grade bonds has narrowed to its lowest level in 2019 and is near historic lows.

3. Signs of stress in the weakest parts of the market – Despite strong overall performance in the high-yield bond market, there are signs of stress. One such signal is the increase in the number of bonds trading at “distressed” levels. “Distressed” bonds are defined as those issuers who’s spread to the relevant U.S. Treasury exceeds 1,000 basis points, or 10%. The number of bonds trading at “distressed” levels has increased by 63% in the past 12 months.

Sage Positioning

As a result of this changing view, Sage has elected to trim high-yield exposure where we had individual bond positions – taking profits on some longstanding trades, including debt issued by Hilton Worldwide, T-Mobile, Ardagh Group, Cheniere Energy Partners, and Western Digital. Sage has also tactically shifted away from “crossover” credits, or credits that hold investment grade ratings from one agency and high yield from the other.

Investment grade spreads often follow trends in the high-yield markets, so Sage has also shifted its investment grade exposure away from riskier credits and towards higher-quality ones.

*Source on all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Auto Loan Losses: Navigating Through the Noise

by Seth Henry

Over the last few quarters, there have been numerous news headlines noting the rise in auto loan delinquencies. The headlines tell only part of the story, however, as many of the losses can be attributed to subprime auto loans, which comprise roughly 40% of the auto loan market.

Over the past decade, losses on automobile asset-backed securities (ABS) had actually trended downward and reached historic lows. This is due in part to the strong financial position of the American consumer. A decade of historically low rates combined with very low unemployment helped to keep the consumer in a stable environment and auto loan defaults relatively low. While it is true that delinquencies and losses have increased, this is due primarily to losses in the subprime portion of the auto loan market, which is $55 billion of the $140 billion market. Specifically, delinquencies and losses have increased for subprime issuers who have a poor track record for underwriting and managing risk.

While current losses on prime auto loans are higher than their historical lows (0.56% vs 0.30%), they are still very low and well within expectations.

Over the last five years, smaller-scale (non-benchmark) subprime issuers have seen losses increase from 7.60% to 9.90%, a much larger increase that weighs on the sector as a whole.

Despite subprime auto weakness, Sage believes that prime auto borrowers are in a healthy position and do not pose a systemic risk. Given the strong job market, consumer ABS is still a healthy sector with a compelling risk-reward value. The sector is largely AAA-rated, and a great alternative to other high-quality, lower-yielding assets.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Notes from the Desk: Is Now the Time to Extend Duration?

by Robert Williams

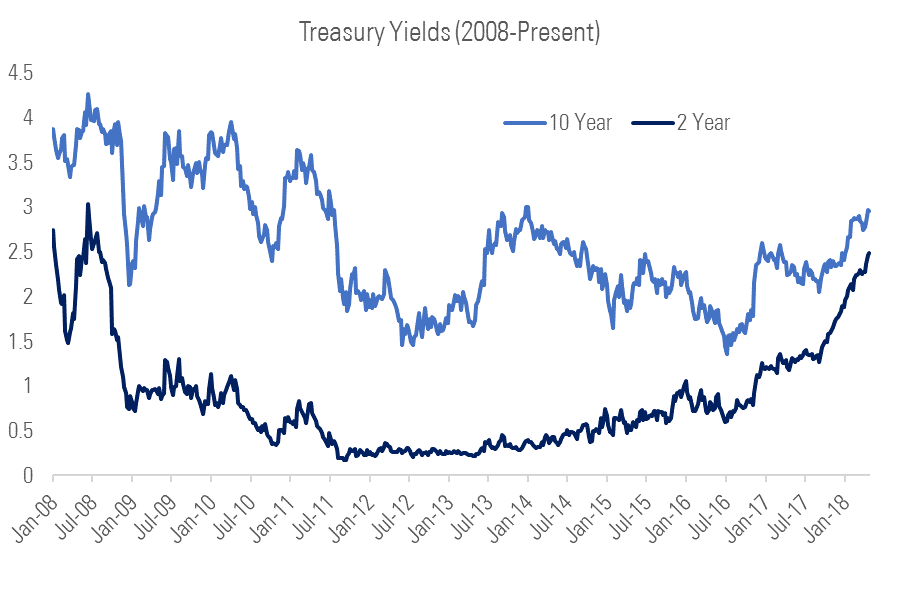

Cash and ultra-short fixed income investors continue to enjoy the fruits of nine Fed rate hikes. Yields on cash hover around 3% with relatively low interest rate sensitivity. However, with the Fed done raising rates, core yields now 60 basis points lower than six months ago, and the economy in the later part of the cycle, bond investors who tactically shifted to cash and ultra-short allocations should start to think about whether or when to extend out the curve. The decision to extend duration to a short or intermediate duration strategy depends largely on an investor’s expectation for the yield curve.

What is curve telling us and where does it go from here?

The yield curve has flattened to near zero, as it typically does during a Fed tightening cycle, usually as a precursor to an inversion and a recession. With the Fed signaling no further hikes and the U.S. still experiencing decent grow, curve inversion in the near-term appears unlikely. In fact, markets are now pricing in a probability, albeit low, of an interest rate cut as early as the end of 2019. Where we go from here requires an outlook call on growth and inflation. Below we outline our outlook in three scenarios, including their likely impacts on the curve.

Outlook Scenarios (Next 6-12 Months)

Base Case and Recession Expectations

Our base case is for low, but stable growth in the U.S.; a modest uptick in inflation, which keeps the curve flat; and a modest steepening bias possible. We see the greater risk of this backdrop eventually transitioning to weakness, rather than above trend growth, and expect the next directional move in the curve to be a steepening bias as the Fed cuts rates. This part of the scenario looks further down the road, as the curve and data suggest near-term recession odds remain low. While portions of the curve briefly inverted in March, it didn’t last more than a couple days and regardless, the lag time between curve inversion and recession or even market peaks are typically several quarters. Recent data trends in the U.S. have been improving, which has been putting more slope back in the curve, but not so strong as to put the Fed hikes back on the table and cause a flattening/inversion trend to resume.

Extending and Historical Returns

Given our outlook, the idea of at least beginning to consider a strategy extension makes sense given the higher probability of a flat-to-modest steepening environment and a more limited chance of near-term inversion or meaningfully higher long rates. We also looked at past curve environments to understand return differences historically when moving out in duration. We used the last four curve inversions referenced in the table below as a basis.

For each period, we calculated returns across cash, short gov/credit, and intermediate gov/credit across three periods:

- Flattening: 6 months leading up to the inversion

- Flat/Inverted: the inversion period

- Steepening: 6 months after the end of the inversion period

The results illustrated below also support the idea that cash makes sense in periods when the yield curve is flattening during a tightening cycle, but that post-cycle it has made sense to move out on the curve.

Given our current outlook, likely curve scenarios, and historical returns data, cash and ultra-short strategies still makes sense, but investors should start considering at least a push out to short strategies. Further, as the curve continues to steepen near-term, the risk/reward will become increasingly favorable for extending to an intermediate duration strategy.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Looking Beyond Yield in a Multi-Asset Income Strategy

Multi-asset income (MAI) strategies can be an excellent fit for investors who need higher levels of income and have a more moderate risk budget as compared to what a traditional fixed income portfolio may allow. Unfortunately, we are now in the part of the economic cycle where some investors will reach too far for yield without considering the risk of those higher-income markets. Investors seeking income through multi-asset strategies should consider the volatility and correlation to equities of many of these strategies.

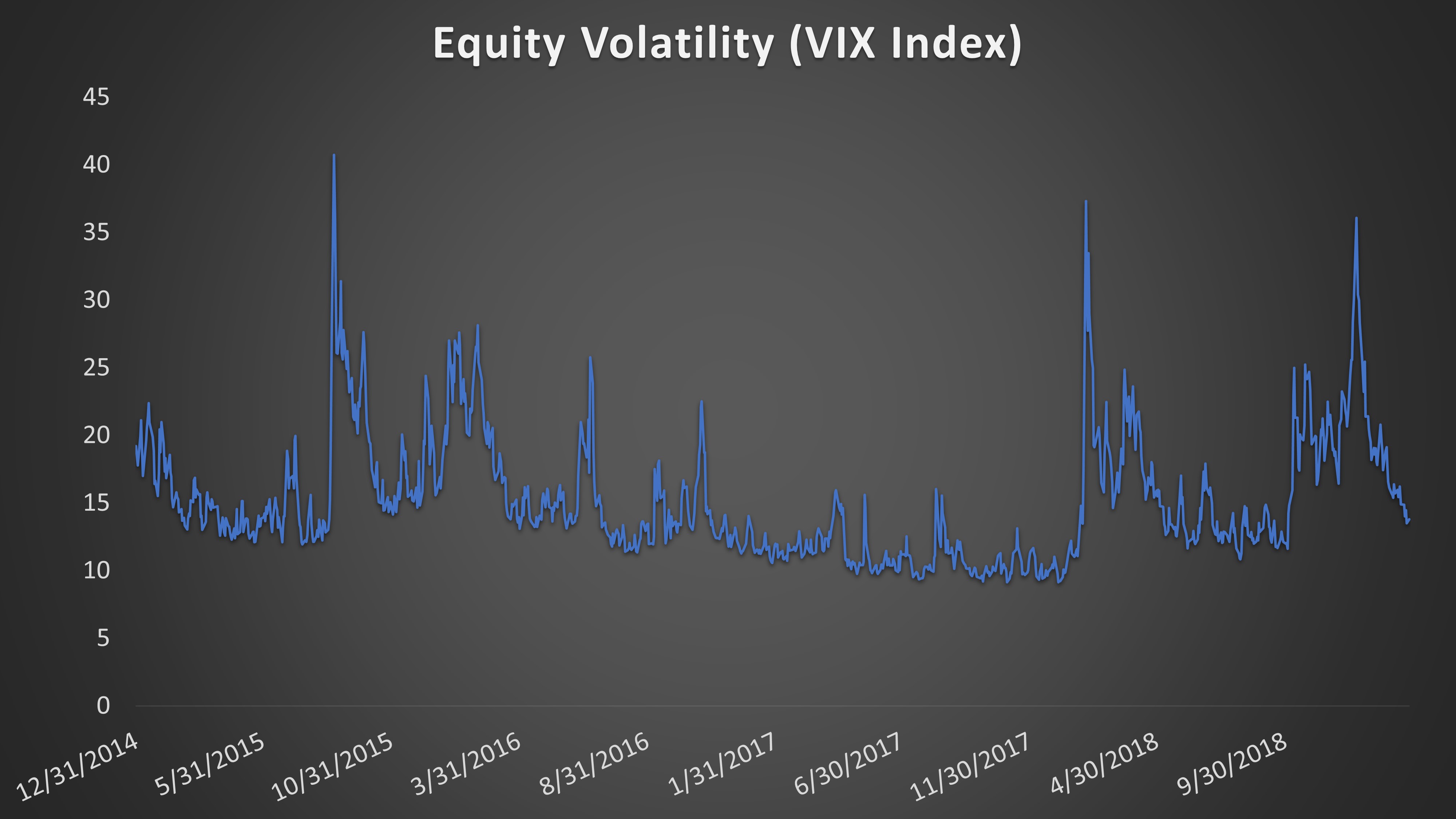

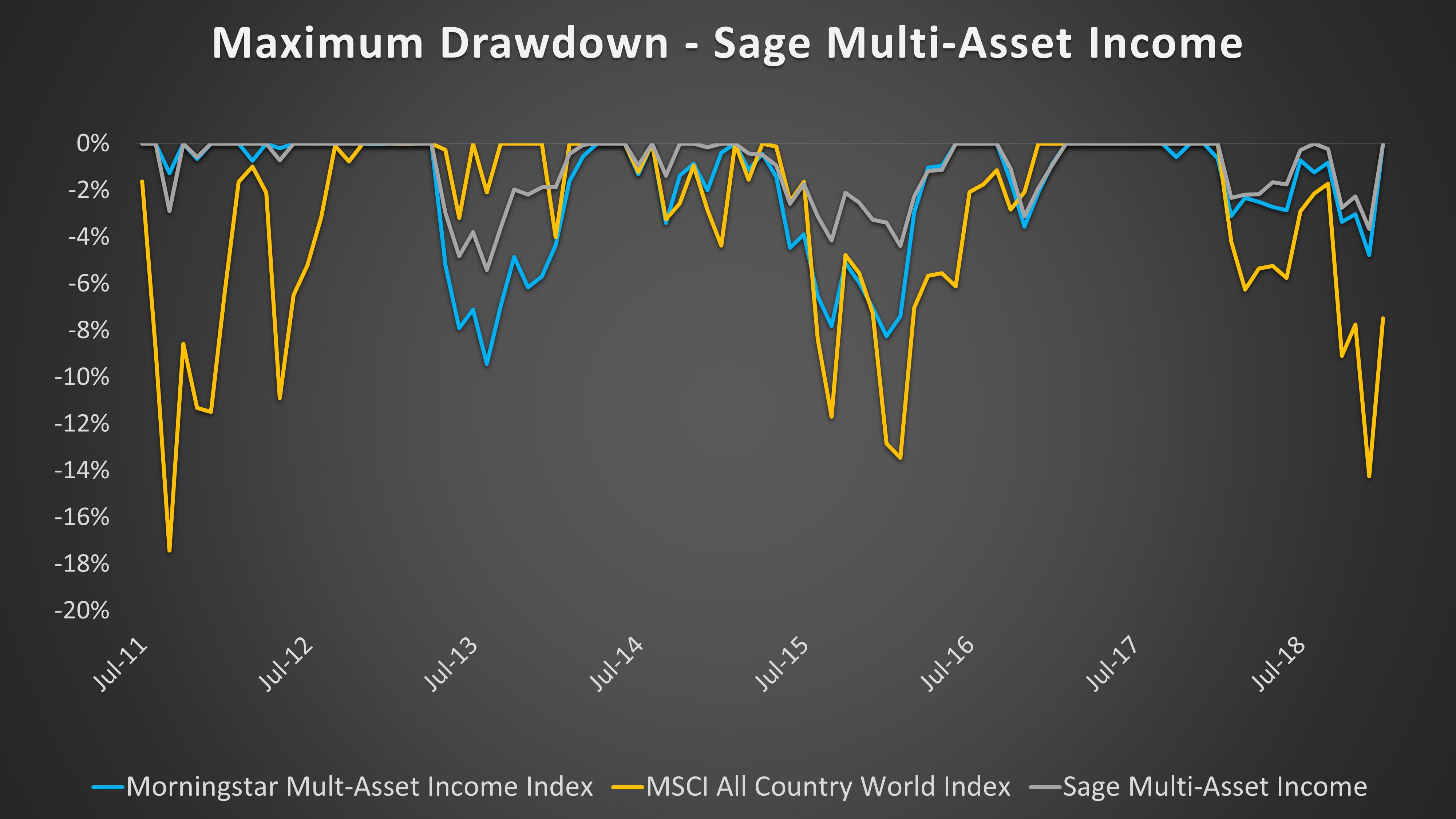

While many MAI strategies have boasted equity-like returns during the recovery, they have also come with equity-like volatility. This was evidenced in 2018, as most MAI funds experienced negative returns, similar to equities. Before 2018, the last year there was a spike in volatility was 2015; MAI funds also struggled that year. The reason is that most MAI strategies rely heavily on high-dividend equities and equity-like markets, such as preferred stocks, high-yield, and alternative fixed income (such as MLPs). This is appropriate to generate higher yields, but if it’s not balanced with an allocation to core high-quality fixed income and managed with overall risk level and volatility in mind, it will lead to a large drawdown in risk-off markets and a high correlation to equities.

We believe that for income-focused investors, large drawdowns and high correlations to equities are unacceptable. Sage’s MAI strategy is managed on a yield-to-volatility concept, where we measure the attractiveness of an income-generating market not by yield alone, but also by its ratio of yield-to-volatility. This ensures we are not gravitating too strongly toward high-income markets with rising volatility or “reaching for yield” in an environment of increasing risks.

At Sage we manage the portfolio with a “risk budget,” so our portfolio’s volatility is closer to a fixed income index than an equity index. This ensures that our portfolios are always well diversified, have a core allocation to high-quality fixed income, and act more like a fixed income portfolio in volatile markets than an equity portfolio. While this approach puts us on the more conservative side of the typical MAI strategy, we will gladly sacrifice modest levels of income and return in bull markets for a more soundly constructed income allocation. In the long run, it’s Sage’s MAI strategy is about 1) generating consistent income without the risk of giving years’ worth of that income back in one drawdown, and 2) providing clients a smooth ride along the way.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Rising Interest Rates: A Short Guide for ETF Investors

A rising tide lifts all boats, but do rising rates lift all assets? The yield on 10-year Treasury notes rose above 3% last week – the highest it’s been since 2014 – and the yield on two-year Treasury notes hasn’t been this high since the 2008 financial crisis.

When interest rates rise, many investors fear a negative effect on the economy. A combination of rising inflation, increased bond supply, and the Federal Reserve’s tightening policy have caused the recent increase in yields. In what ways could higher rates lead to lower growth, and more importantly, how should we as ETF investors position ourselves?

Higher Rates – A Risk Factor for The Economy?

Here are how higher interest rates could negatively affect growth:

- Rising interest expense for the corporate sector. Companies that finance their operations with debt incur interest expense, which drives down profit margins. According to JPMorgan, a 100 basis point increase in bond yields typically results in a 1.5% drag on S&P 500 earnings (not including financial services companies, which would see a benefit to earnings). Until recently, rates had remained relatively low since the financial crisis, and the lower interest expense has been a huge driver of corporate profit margins. Increasing rates would in theory reverse that trend. However, the impact of higher rates is mitigated by the fact that corporate debt has generally been issued at longer maturities (an average of 10-plus years) and at fixed rates, so rising interest expense is not an immediate concern at the macro level.

- Lower consumer demand due to rising interest expense for households. Higher interest expense decreases the level of disposable income, which should lower consumption and as a result, reduce GDP growth. This impact is somewhat mitigated as households have deleveraged over the past decade, and household debt service ratios remain at multi-decade lows.

How Higher Rates Negatively Affect Equities:

- Reduced value of future earnings. In its purest form, equity prices reflect the discounted future earnings of a company. Higher interest rates increase the discount rate, thereby lowering the company’s present value. If rising interest rates aren’t offset with higher top-line growth, either through higher prices (inflation) or higher volume (more demand), then equities could be in trouble as market participants price in a higher discount rate.

- Declining attractiveness of equities as earnings yields decline. When earnings yields significantly exceed bond yields, it becomes cheaper for companies to finance projects, M&A, and share repurchase programs. When the difference between earnings yields and bond yields is zero or negative, the equity-market boosting behaviors could slow or stop. With increasing bond yields and high stock valuations, that gap has been decreasing, but it still remains at above-average levels. So while it’s not a red flag yet, if the gap continues to narrow, it could drive stock prices lower.

A rising rate environment does not signal immediate danger for the economy, since the private sector has deleveraged a great deal since the crisis and the Fed has been very methodical in communicating future rate hikes. However, markets are forward-looking and investors could start to price in the effect of higher interest rates on financial assets before they actually materialize. At Sage, we believe sectors that stand to outperform from rising rates are financial services, such as banks and insurance companies; inflation-protected bonds; and the senior loan market, which provides exposure to corporate debt without the corresponding interest rate risk.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.