Our tactical ETF offerings range from 100% fixed income to 100% equity, including a series of target risk and target date asset allocation strategies. While we maintain a high level of complexity within our investment process, we choose to express that complexity by using straight-forward, market segment oriented ETFs. Each asset allocation strategy will hold, on average, 10-20 ETFs at any given time.

Tag: Tactical ETF

Sage Advice Tactical ETF Quarterly Market Review 2Q2020

While the equity rebound has been impressive, stocks still find themselves down for the year and facing a back half full of challenges. Near-term sentiment is riding high on rebounding data that has been surprising to the upside and strong policy efforts that have been supporting markets and the economy. Policy support may prevent a collapse in risk assets, but hindrances to meaningful upside include higher valuations and uncertainty surrounding the virus, earnings, and political fronts. For fixed income returns, we hold an optimistic outlook. Despite meaningful spread tightening over the last three months, valuations in most spread sectors are still priced for upside, while equities appear more fully valued given the rebound. High yield and other non-core fixed markets especially look attractive from a risk/reward perspective than most core equity markets.

The U.S. Economy – Signs of A Sneaky Slowdown

By Komson Silapachai

We are in the longest U.S. economic expansion in modern history.

Barring a black swan of epic proportions this month, the U.S. economy will break the record in June for the longest expansion since 1854. The current leader, which is soon to be surpassed, is the 1990’s economic expansion, which lasted for 10 years. Is this a cause for a celebration, or is the economy due for a downturn?

Economic expansions don’t die of old age. Just because the expansion has lasted this long doesn’t mean it should end. In fact, there are many positive indicators of why this expansion should continue. Private-sector balance sheets remain strong, as financial assets and home prices are near all-time highs. The labor market is solid – the U.S. unemployment rate stands at 3.6%, just 0.2% from its all-time low. Inflation remains subdued and serves as a tailwind to the economy, as the Federal Reserve has not moved to tighten conditions.

An additional positive indicator, the Chicago Fed’s National Financial Conditions Index, which indicates conditions in debt, equity, and “shadow” banking systems, illustrates that financial conditions are at their easiest levels post-crisis.

However, we’re starting to see initial signs that the economy could be softening. While we don’t believe these indicators point to an imminent recession, the economy is experiencing a material slowdown that warrants observation for the remainder of the year.

1. Business Loan Activity

The Federal Reserve’s Senior Loan Officer Survey’s measure of business loan activities points to moderation in business investment. The percentage of loan officers reporting stronger demand are the lowest in the post-crisis period, while loan standards have moved tighter since the second half of 2018.

2. Transport Volume

Key transportation indicators have turned negative. The Association of American Railroads has reported a slowing in U.S. rail traffic volumes, with total volumes falling in the first 17 out of 19 weeks in 2019.

3. Industrial Output

Capacity Utilization, which measures the percentage of realized potential industrial output and economic slack, has been declining since its peak in October 2018 and is at a 14-month low.

4. Manufacturing Demand

The widely followed ISM Manufacturing Purchasing Manager’s Index (PMI), which surveys purchasing managers at over 300 manufacturing firms, has moved sharply lower in recent months. A PMI index above 50 indicates an expanding economy, and a move below 50 indicates a contraction. While the indicator stands in expansionary territory at 52.5, it has declined from its peak in August 2018 of 60.8. A sustained move below 50 would signal a serious slowdown, if not a recession; however, we are not there yet.

5. Economic Activity

The Chicago Fed’s National Activity Index, which is a composite of 85 indicators of national economic activity, has turned lower and points to below-trend growth in recent months.

As the U.S. economy moves into its longest expansion in modern history, we are seeing signs of a slowdown bubbling under the sanguine labor market and easy financial conditions. Whether the dip is transitory, as it was in 2016, or a herald of a larger slowdown remains to be seen. It all depends on the outlook for monetary and fiscal policy, as well as a potential fallout from slowing global trade.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

February Equities Outlook in 5 Charts

1. The U.S. consumer remains a bright spot amid slowing economic activity abroad and a cooling U.S. corporate sector.

2. Equity indices have recovered the bulk of their losses from the fourth quarter and valuations appear fair. Given a more challenging macro picture, fixed income has become the more attractive asset class.

3. Some sectors, such as Tech and Industrials, have reaped strong year-to-date returns. Given continued volatility and slowing trends, this has created a case for more defensive sectors.

4. Political risks and slowing economic data has created a tepid view toward developed international markets versus the U.S.; however, markets have already discounted much of this risk.

5. Sentiment toward emerging markets equities turned positive in mid-2018, and investors continue to show confidence in the region due to a more dovish rate environment and expectations for further stimulus from China.

The source for all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Notes from the Desk: Central Banks Are No Longer a Major Pain Point

With the interest rate markets pricing in no hikes for 2019, there was room for the FOMC to disappoint at its January meeting; however, they ended up surpassing the most dovish of expectations. As a result, risk assets rallied sharply in January as global central banks followed in the Fed’s footsteps in easing financial conditions.

In his statements, Chairman Powell signaled that the case for additional rate hikes had weakened and declined to rule out that the next move in rates would be lower. Most importantly, the Fed said that it was prepared to adjust its balance sheet normalization to economic and financial developments. Basically, if raising rates or lowering the size of the Fed’s balance sheet turns out to negatively affect markets, Powell and the FOMC would adjust policy as necessary.

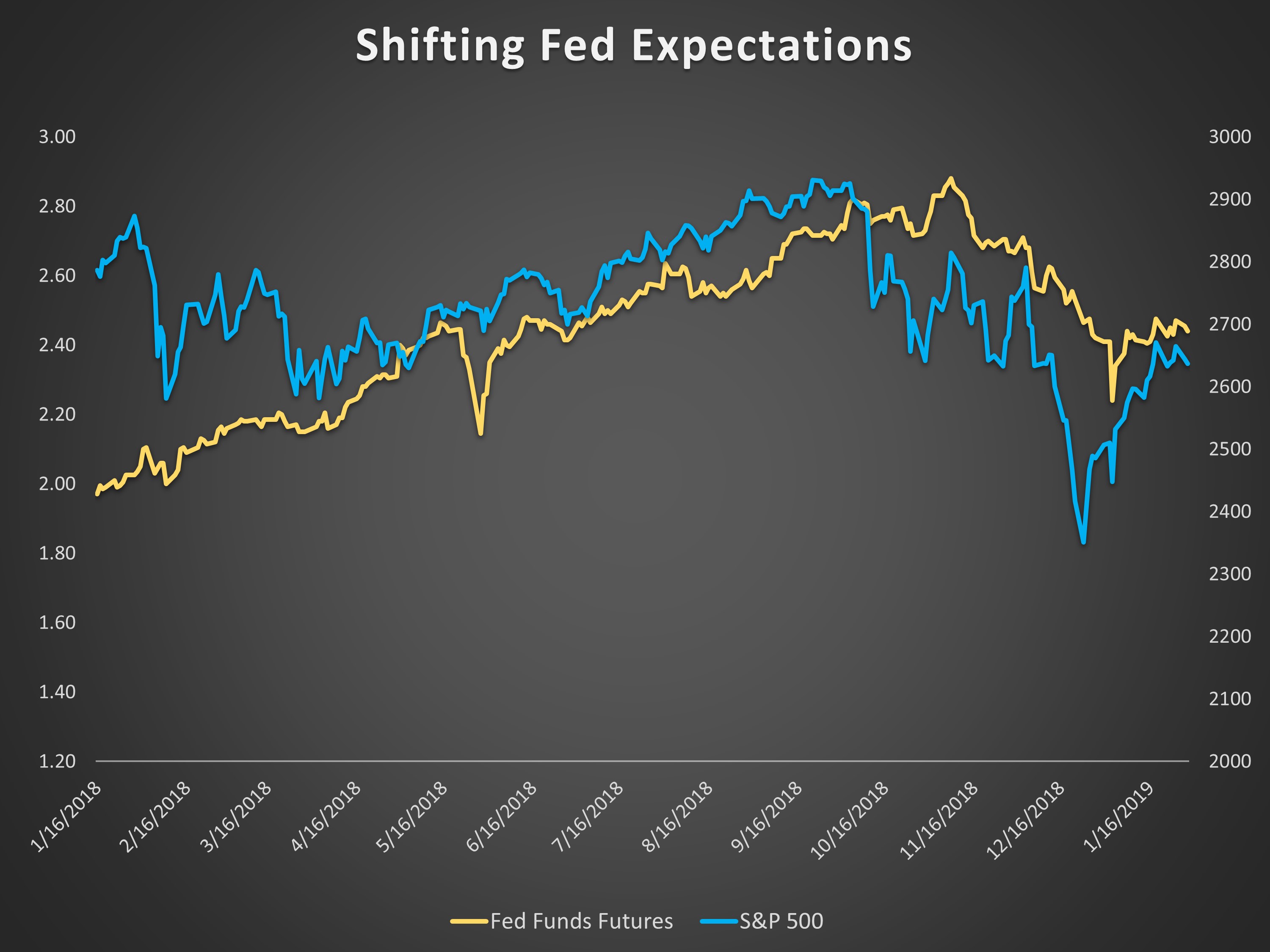

Thus resumes the cycle of central bank policy acting in response to financial markets. The chart below shows the 12-month forward federal funds rate compared to the S&P 500. Expectations of Fed policy have traded in lockstep with the equity markets.

Given our focus on balance sheet policy as a source of risk asset fragility, this action removes a major point of uncertainty for financial markets over the next few months. We’re still wary of a material slowing in the global economy, but as of this week – it doesn’t look like central banks will be part of the problem.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

ETF Trends Video: Bob Smith

Our President & CIO, Bob Smith, sits down with ETF Trends to discuss our approach to managing ETF strategies.

ETF Risk Management

September 7, 2016 — Interested in learning more about our risk management process at Sage? See what our Director of Research, Rob Williams, has to say about intra-cycle risk.

Sage History & ETF Adoption

September 7, 2016 — Sage was established with a simple mission: to better meet the unique investment management needs of institutions and individuals through industry-leading analytical services, innovative investment solutions and an unwavering focus on risk management. Sage is headquartered in Austin, Texas, which provides a physical environment consistent with the philosophical vision for Sage—the perfect landscape for independent thinking and purpose-driven investment management.