by Jeffrey Timlin

- At current valuations, should I wait to invest cash in the municipal market?

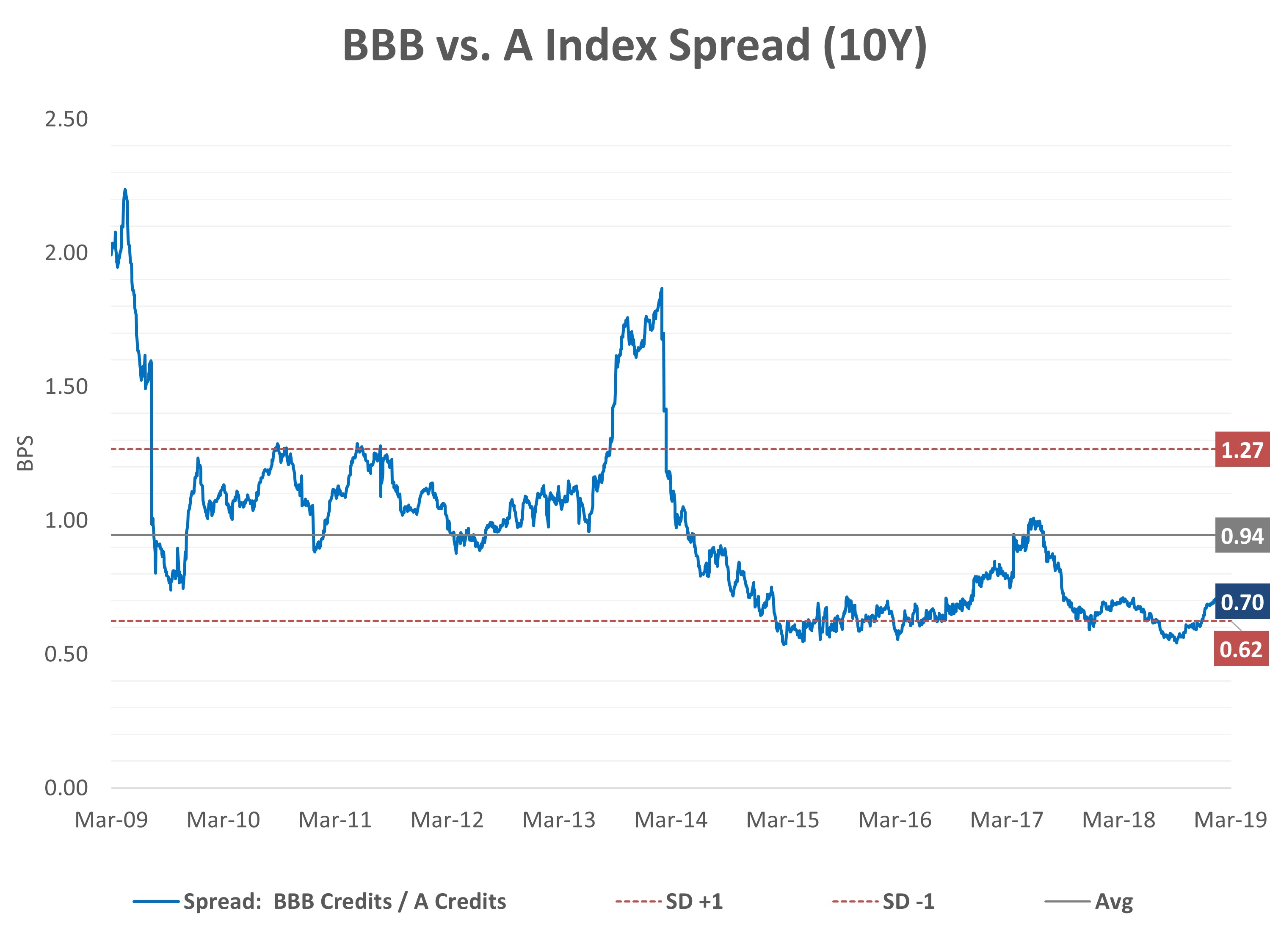

All things being equal, history has shown that bonds outperform cash over most time periods. Although municipal valuations are not super attractive right now, every asset class is rich and trading at or near their all-time highs. The benefit of municipal bonds is not only tax-free income, but as an asset class, it is negatively correlated to the broad market during market downturns. If equities enter a corrective phase, municipal bonds typically hold up well and may even experience modest price appreciation.

- When will the strong technical environment normalize?

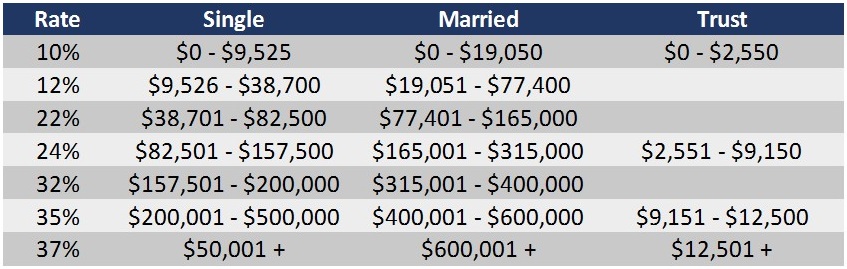

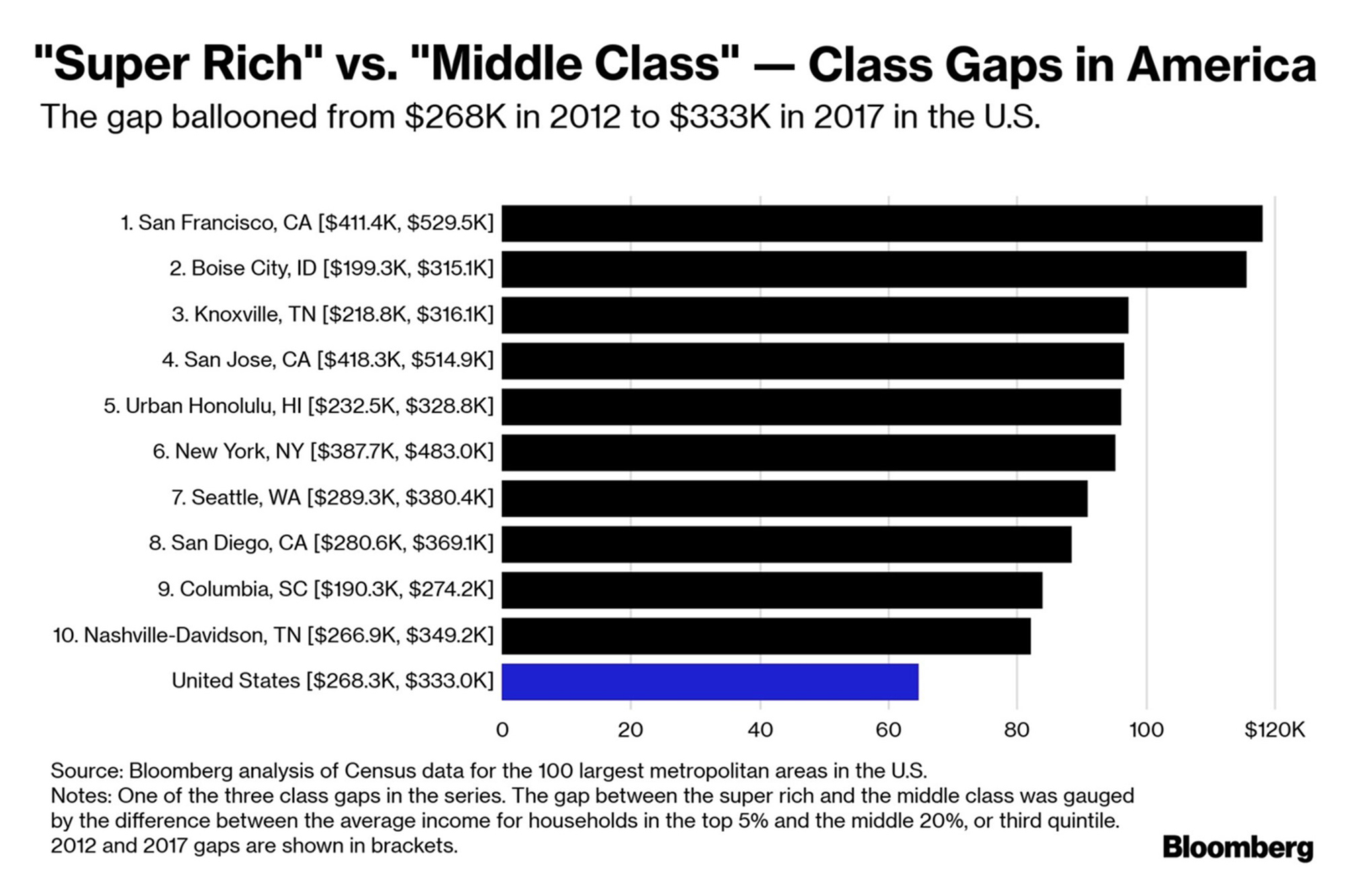

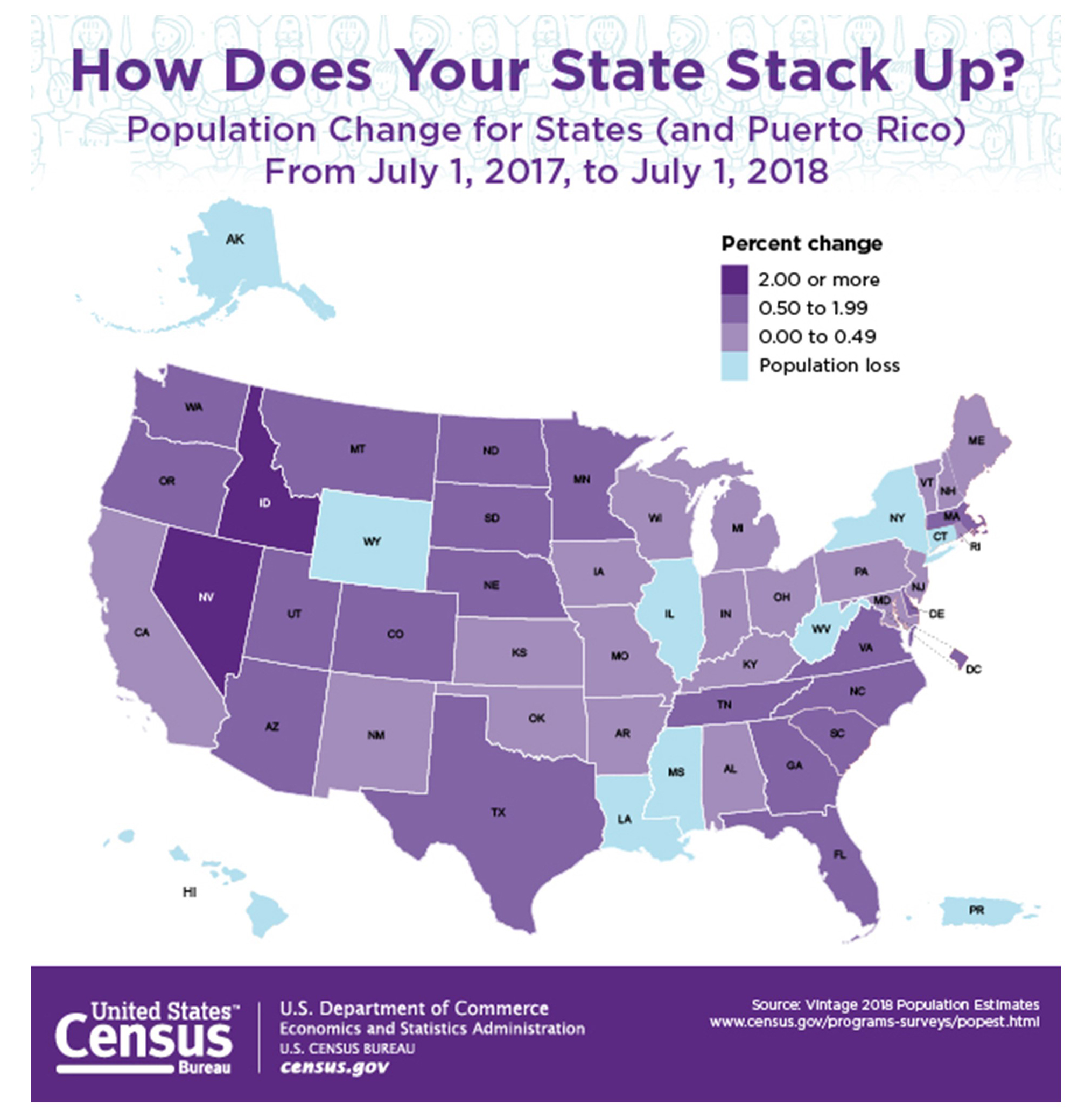

To be sure, the record municipal cash inflows experienced year-to-date cannot last forever. The caveat to that remains the ongoing reduction in new issue supply, as well as the elevated levels of maturity and coupon payments coming due. Historically, periods of significant outflows have coincided with negative returns as investors and funds alike were forced to liquidate positions to raise cash. Unlike those periods, the current environment shows mutual funds sitting on higher levels of cash and they are cushioned by higher levels of maturity and coupon roll-off. Lastly, as a result of the decade-long recovery, a record number of millionaires now reside in the U.S. – more than 11 million people. These millionaires benefit fully from the tax-exempt income offered by municipal bonds, especially the ones who live in high-tax states.

- Are there any credit issues that I should be concerned with?

Overall, there are no serious credit concerns within the municipal market. Several well-known credits, such as the State of Illinois, City of Chicago, and Puerto Rico remain challenged and should be reviewed on a quarterly basis. Although mid-to-long-term issues do exist regarding pension and health care funding levels, there is not cause for immediate concern. Due to the monopolistic characteristics and taxation powers inherent in most municipal issuers, the municipal market remains one of the safest areas within the fixed income markets.

- I am worried about losing money in fixed income. What can I do to protect myself?

Many investors overestimate the downside risk of municipal bonds. Over the past 15 years, a core municipal strategy that has an effective duration of approximately six years and invests in maturities out to 30 years only had two negative-return years: 2008 (-2.49%) and 2013 (-2.55%). Even on a quarterly basis, the worst return during that time was -4.17% in the fourth quarter of 2010, after Meredith Whitney’s bogus municipal default prediction. To put that into perspective, the worst quarterly return for municipal bonds has occurred to daily returns in the equity markets on a fairly consistent basis. For investors looking to minimize downside risk, municipal strategies with a duration of four years or less tend to offer an attractive yield, while limiting principal loss on a yearly basis.

- Why does it take a few weeks to get my portfolio fully invested?

Municipal portfolio cash could be invested in a day or two, provided the investor is not concerned with valuations or optimizing their sector and credit profile. Unlike equities, which are constantly available, municipal bond supply ebbs and flows daily. A bond that trades today may never trade again if held by buy-and-hold investors. In addition, Sage is a value-based investor that screens the market for attractive offerings. A combination of new issue, secondary offerings, and bid wanted are utilized to source bonds at attractive levels. Each of these avenues opens and closes daily and takes time to access. Sage believes that having the patience to wait a few weeks to purchase the most attractive offering will pay dividends in the long run.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.