The Fed’s response to the economy and market breakdown engendered by the COVID-19 crisis has been unprecedented — not only in scale, but how quickly new policy tools have been used to address rapidly tightening financial conditions. The following is a short post intended to demystify the “alphabet soup” of Fed tools and what each tool is trying to fix, and provide a list of additional policies we can reasonably expect in the near-term.

A global health crisis ultimately requires a scientific solution, but earlier this month within the span of days, the health crisis morphed into economic stress (with the uncontained spread of COVID-19 in Italy), and eventually threatened to become a full-blown financial crisis (after the OPEC oil shock on March 7). Ultimately, the intensity of the Fed’s policy tools was targeted at containing and preventing market stresses from turning into a financial crisis while the world dealt with COVID-19.

Notable policy tools the Fed has employed thus far include:

Interest Rates Cut to Zero

The Fed has cut rates to zero, first on March 3 by 50 basis points, and by a further 100 basis points on Sunday, March 14. As market stresses intensified effects on short-term fixed income both in the U.S. and overseas, which was caused by interest rate differentials, the FOMC had to cut rates to zero two days before its scheduled March meeting, underscoring the urgency of the situation.

Unlimited Quantitative Easing (QE)

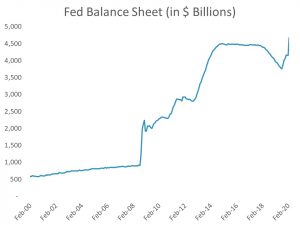

The Fed started a $700 billion QE program on March 14, and nine days later, it expanded the size of QE to be open-ended. To put this into perspective, after the global financial crisis (GFC), the span of QE1 to QE3 took 5 years. It took only nine days for the Fed to expand QE to be open-ended. Put another way, the Fed will buy more assets this week than it bought post-GFC during the years 2010 to 2012.

Commercial Paper Funding Facility (CPFF)

In order to support the commercial paper market, which is a short-term funding vehicle for the corporate sector that seized up last week, the Fed announced a $100 billion purchase program backed by $10 billion of funds to cover loan losses from the U.S. Treasury’s Exchange Stabilization Fund (ESF) (typically used to intervene in foreign exchange markets).

Money Market Mutual Fund Liquidity Facility (MMLF)

On March 18, the Fed created the MMLF to lend money to banks so that they can purchase assets from money market mutual funds, supporting functioning of the money markets. Again, this program is $100 billion in size, backed by $10 billion from the U.S. Treasury’s ESF.

Corporate Credit Facility (PMCCF, SMCCF)

On March 23, the Fed created two vehicles to purchase corporate bonds in both the primary and secondary markets. Notably, the Fed announced the purchase of corporate bond ETFs. This program to buy IG corporates was truly a new tool (not used during the GFC), which has calmed credit markets in the near term. The total size of this program is $300 billion, backed by $30 billion from the ESF.

Term Asset-Backed Loan Facility (TALF)

Also on March 23, the Fed established the TALF to buy asset-backed securities that are backed by auto, student, or small business loans. The capacity of this vehicle is included in the $300 billion to buy corporates and ETFs.

Our takeaways and expectation for future policy:

The Fed and U.S. Treasury are in coordination, and thus, monetary and fiscal policy are one.

The Fed is in the fiscal arena now. By creating vehicles to effectively support the debt markets and make loans to businesses backed by the U.S. Treasury, the Fed is now squarely conducting fiscal policy, and we believe this trend will continue with future policy moves.

The Fed will roll out a Main Street Business Lending Program.

The Fed announced a “Main Street Business Lending Program,” the specifications of which are currently unknown, but we believe it will be of similar structure to the ESF-backed facilities mentioned previously.

These facilities and programs are going to get larger, much larger.

In the CPFF, MMLF, SMCCF, etc., the lending capacity of these vehicles are backed by capital from the U.S. Treasury. For every dollar from the U.S. Treasury, there may be 10 dollars of lending capacity. Of the announced programs, there is roughly $500 billion of lending/market support capacity backed by $50 billion of capital from the ESF. The “Phase 3” stimulus bill upsizes the ESF by $450 billion. Put a 10x multiplier on that and $4.5 trillion is the size of market support and lending capacity that would be available to the Fed. To put this into perspective, the Fed’s balance sheet is currently at $4.6 trillion after over a decade of monetary accommodation since the GFC! A $2 trillion fiscal stimulus program could have the effect of a $6 trillion stimulus program, which is over 30% of U.S. GDP! That would dwarf any stimulus deployed during the GFC by multiples.

The Fed and Treasury are truly doing “whatever it takes.”

We are optimistic that market functioning and liquidity will slowly return. The Fed and Treasury have shown a sense of urgency to support the economy during the COVID-19 pandemic and hopefully, when the virus starts to taper off, we believe we could see a material rebound in financial assets.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.