The Sage Moderate Growth tactical ETF strategy is a global asset allocation portfolio that is managed consistent with the risk orientation of a moderate growth investor. The strategy will invest in the global fixed income, global equity and alternative market segments. Tactical allocation decisions will be applied on two levels; at the broad asset class level and within the various fixed income, equity and alternative market segments.

Tag: ETF

Moderate Strategy Profile 1Q20

The Sage Moderate tactical ETF strategy is a global asset allocation portfolio that is managed consistent with the risk orientation of a moderate investor. The strategy will invest in the global fixed income, global equity and alternative market segments. Tactical allocation decisions will be applied on two levels; at the broad asset class level and within the various fixed income, equity and alternative market segments.

Conservative Strategy Profile 1Q20

The Sage Conservative tactical ETF strategy is a global asset allocation portfolio that is managed consistent with the risk orientation of a conservative investor. The strategy will invest in the global fixed income, global equity and alternative market segments. Tactical allocation decisions will be applied on two levels; at the broad asset class level and within the various fixed income, equity and alternative market segments.

ACE Plus Strategy Profile 1Q20

The Sage All Cap Equity Plus tactical ETF strategy seeks to provide strong risk-adjusted investment returns relative to the global equity market. The strategy will invest primarily in core domestic and international equity markets and will tactically allocate between 0%-40% in non-core segments such as emerging market equity, commodities, real estate and currencies.

Core Plus Fixed Income Strategy Profile 1Q20

The Sage Core Plus Fixed Income tactical ETF strategy seeks to provide excess yield and strong risk-adjusted investment returns relative to the Barclay’s Aggregate Bond Index. The strategy will invest primarily in core fixed income and will tactically allocate between 0%-40% in non-core segments such as high yield, non-dollar, emerging market debt and preferred stocks. The tactical allocation decisions will be determined by the desired portfolio duration, yield curve management and opportunities in non-core market segments.

Putting Trade into Context: Sage’s Outlook on Emerging Markets

For over a year, U.S.-China trade tensions have seized investor sentiment and dominated headlines. While tariffs and a potential resolution to the current episode are important for near-term price action, it’s only one piece of the puzzle. At Sage, we take a broader view on China and trade to determine our outlook for Asia and its effect on emerging markets (EM).

The fundamental issue facing global growth is that the source of China’s economic growth is changing. The country is shifting its growth model from one of exports and fixed investment spending to consumption-led growth. Officials have attempted to rein in China’s debt levels from the high credit growth of the past 15 years, which should result in a lower, but sustainable rate of growth. U.S. exports are a relatively small contribution to Chinese GDP, and the risk of trade tensions has been more about how it could affect business and investor sentiment than the impact on economic growth. The threat of tariffs was a catalyst for last year’s EM selloff, but those risks have been mitigated given a potential trade agreement between the U.S. and China in the coming months.

When we look past trade tensions, the underlying issue is that the Chinese economy is in a material slowdown. The chart below shows global manufacturing activity as measured by the Purchasing Managers’ Index, a common leading economic indicator. Chinese manufacturing activity has slowed to a level that indicates an economic contraction.

Chinese policymakers have responded with fiscal stimulus but have yet to introduce a liquidity injection to boost the property sector, which was China’s playbook for 2016. While the recent stimulus measures will help, its “impulse,” the effect that it will have on the Chinese economy, may not materialize for six or more months.

China is a huge trading partner to other EM countries, such as Taiwan and Korea, and recent figures from those countries have shown the magnitude of the Chinese slowdown.

In addition, commodity exporters, such as Chile, Australia, South Africa, and Brazil, have seen exports decline in recent months. These export numbers are a bellwether to growth in Asia and have the potential to hurt investor sentiment for EM assets.

Given recent strength in EM equities, particularly China, we have decided to underweight emerging markets throughout our equities, fixed income, and asset allocation strategies. The risk to this view is twofold: 1) flows moving into China due to index inclusion (MSCI) and investor demand, and 2) the economy responding positively to recent stimulus or a trade agreement in the near term (0-6 months). Ultimately, we believe these outcomes are improbable given the rapid buildup of flows and the current extreme positive sentiment surrounding EM assets.

The source for both charts are Bloomberg and Sage, as of 3/13/19.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Rising Interest Rates: A Short Guide for ETF Investors

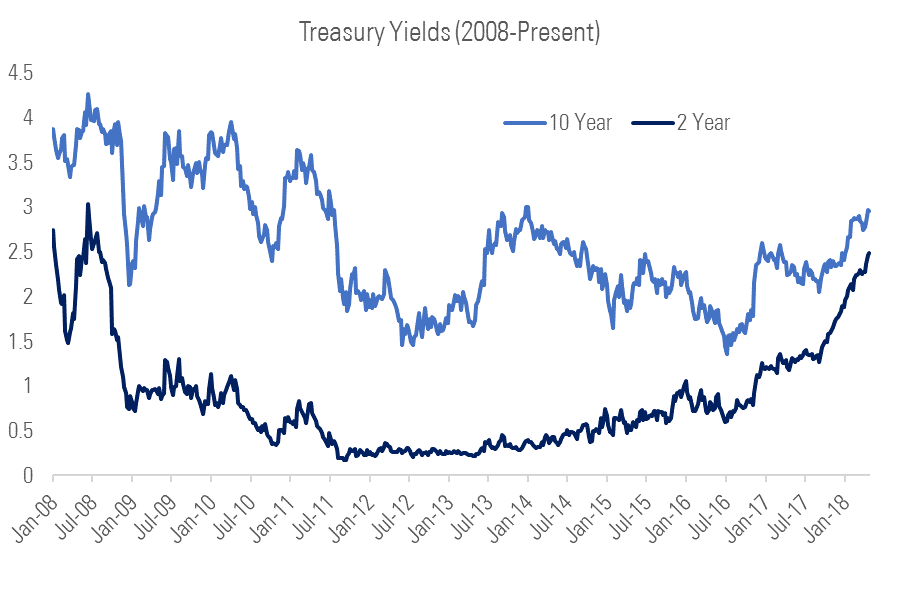

A rising tide lifts all boats, but do rising rates lift all assets? The yield on 10-year Treasury notes rose above 3% last week – the highest it’s been since 2014 – and the yield on two-year Treasury notes hasn’t been this high since the 2008 financial crisis.

When interest rates rise, many investors fear a negative effect on the economy. A combination of rising inflation, increased bond supply, and the Federal Reserve’s tightening policy have caused the recent increase in yields. In what ways could higher rates lead to lower growth, and more importantly, how should we as ETF investors position ourselves?

Higher Rates – A Risk Factor for The Economy?

Here are how higher interest rates could negatively affect growth:

- Rising interest expense for the corporate sector. Companies that finance their operations with debt incur interest expense, which drives down profit margins. According to JPMorgan, a 100 basis point increase in bond yields typically results in a 1.5% drag on S&P 500 earnings (not including financial services companies, which would see a benefit to earnings). Until recently, rates had remained relatively low since the financial crisis, and the lower interest expense has been a huge driver of corporate profit margins. Increasing rates would in theory reverse that trend. However, the impact of higher rates is mitigated by the fact that corporate debt has generally been issued at longer maturities (an average of 10-plus years) and at fixed rates, so rising interest expense is not an immediate concern at the macro level.

- Lower consumer demand due to rising interest expense for households. Higher interest expense decreases the level of disposable income, which should lower consumption and as a result, reduce GDP growth. This impact is somewhat mitigated as households have deleveraged over the past decade, and household debt service ratios remain at multi-decade lows.

How Higher Rates Negatively Affect Equities:

- Reduced value of future earnings. In its purest form, equity prices reflect the discounted future earnings of a company. Higher interest rates increase the discount rate, thereby lowering the company’s present value. If rising interest rates aren’t offset with higher top-line growth, either through higher prices (inflation) or higher volume (more demand), then equities could be in trouble as market participants price in a higher discount rate.

- Declining attractiveness of equities as earnings yields decline. When earnings yields significantly exceed bond yields, it becomes cheaper for companies to finance projects, M&A, and share repurchase programs. When the difference between earnings yields and bond yields is zero or negative, the equity-market boosting behaviors could slow or stop. With increasing bond yields and high stock valuations, that gap has been decreasing, but it still remains at above-average levels. So while it’s not a red flag yet, if the gap continues to narrow, it could drive stock prices lower.

A rising rate environment does not signal immediate danger for the economy, since the private sector has deleveraged a great deal since the crisis and the Fed has been very methodical in communicating future rate hikes. However, markets are forward-looking and investors could start to price in the effect of higher interest rates on financial assets before they actually materialize. At Sage, we believe sectors that stand to outperform from rising rates are financial services, such as banks and insurance companies; inflation-protected bonds; and the senior loan market, which provides exposure to corporate debt without the corresponding interest rate risk.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Is Too Much Optimism Priced Into Risk Markets?

Macro conditions have continued their positive trajectory throughout the first quarter of the year, with US economic activity at the highest pace post-crisis and the labor market showing healthy job creation and wage growth. Meanwhile, global inflation is increasing and downside risks have largely subsided.

Markets are responding with a strong rally in equity markets, higher bond yields, and tighter credit spreads. With this abundant optimism, we would caution against over-bullishness given the fact that current sentiment is largely reflected in current prices.

Risk assets may be prone to bouts of policy-related volatility as the new administration works to implement fiscal stimulus and the Fed tightens monetary policy in response to financial conditions.

Finding Opportunities in Fixed Income

After a sharp spike higher in the fourth quarter of 2016, yields have been largely range-bound this year. The Fed’s forward guidance on rate hikes, coupled with an uptick in inflation data, means that yields could drift modestly higher over the next two quarters. However, we continue to believe that strong global demand for US fixed income will balance tighter monetary policy, keeping rates contained.

Within our asset allocation strategies, we are slightly short duration, maintain an overweight to credit, and hold an allocation to both preferreds and bank loans. Additionally, we recently increased an allocation to TIPS, which look attractive when compared to traditional measures of inflation, including core CPI and wages.

International Equities Show Promise

We continue to be constructive on equities and remain focused on relative value opportunities, holding an overweight to core international markets, which are attractive from a valuation perspective when compared to US equities. We believe developed international equities will benefit from global reflationary trends, weaker currencies, and still favorable monetary policies relative to the US.

As we move towards year-end, policy and politics will continue to dominate the conversation. As optimism wanes, volatility will most likely increase. The best way to weather volatility is by maintaining a sound risk management discipline rooted in relative valuation and fundamental analysis.

For more insight, please visit our Asset Allocation or reach out to the team at 512-895-4130.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. This report is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

ETF Trends Video: Bob Smith

Our President & CIO, Bob Smith, sits down with ETF Trends to discuss our approach to managing ETF strategies.

An ETF Strategy for Sustainable Investing

September 19, 2016 — Sustainable investing is a way for clients to achieve their investment goals while doing good from a global and societal perspective.