Pensions Enjoy Lump-Sum Savings in 2019

February 13, 2019 By Sage Advisory

Lump sum offerings can be valuable in transferring risk away the from plan sponsor by reducing a defined benefit plan’s overall liability exposure. Lump sums can be costly, especially in today’s low interest rate environment, and can have a negative effect on a plan’s funded status. But since interest rates rose during 2018, the result in many cases is lower lump-sum present values in 2019.

As a refresher, pension-plan sponsors generally account for the possibility that they will pay out benefits to their participants over many years. However, if participants choose to receive lump sums, the plan makes a single payment per participant, rather than multiple payments over several years. The result is a reduction of liabilities that the plan carries forward.

The IRS mandates that lump-sum payouts must meet minimum present values as determined in IRC 417(e)(3), with interest rate assumptions derived from mark-to-market corporate bond yields. The plan document defines the method of calculating lump sums with respect to IRC 417(e). Most commonly, a plan will be able to value lump sums with segment rates that are fixed for the entire plan year. This means that any lump-sum payments made in any time of the plan year will use the same segment rates.

For example, if a plan has a stability period of a year, a lookback month of 2, and the lump-sum calculations are for the 2019 plan year (calendar year plan), the November 2018 417(e) rates will be used for all lump sum payouts that occur in 2019. This is important because this means that lump-sum values can vary dramatically from one year to the next based on moves in interest rates and/or mortality assumption updates.

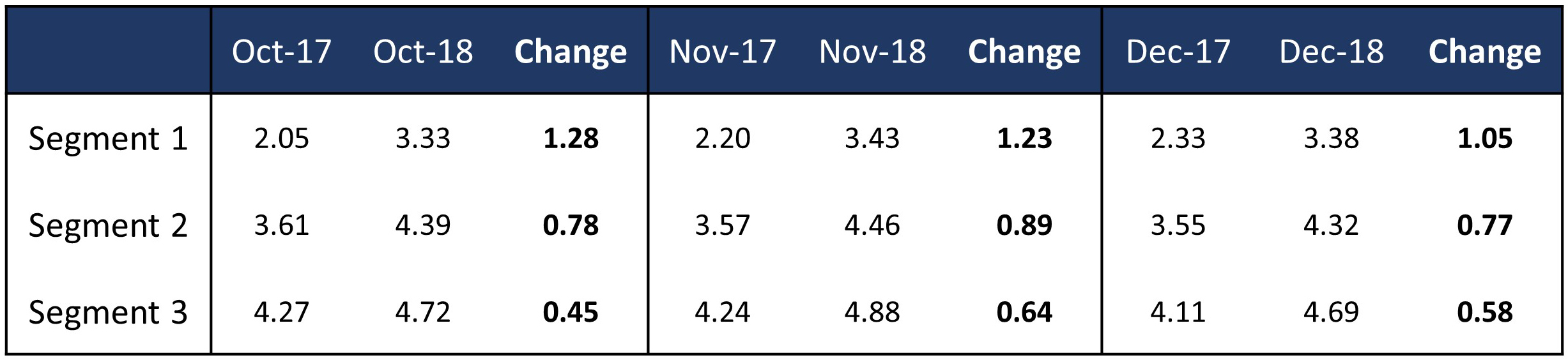

Exhibit 1 shows the changes in the 417(e) segment rates with varying lookback months (based on a calendar year basis). Overall, the rates have increased in 2018.

Exhibit 1. Change in 417(e) segment rates from 2018 to 2019.

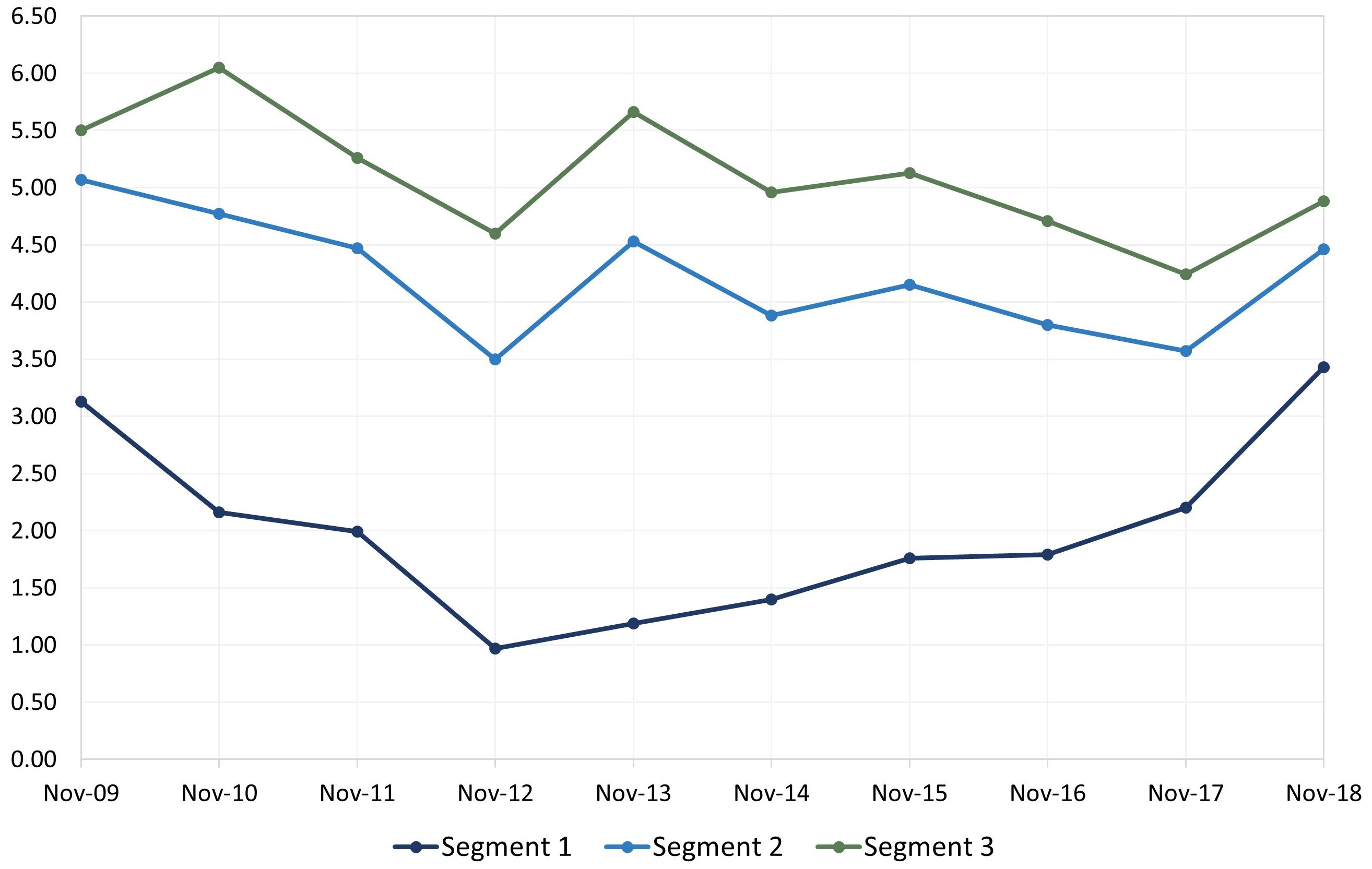

Until recently, the last several years have been a series of declining rates. Exhibit 2 shows the historical November 417(e) rates over the last decade. Long term rates (Segment 2 and 3) have been generally trending downwards since November 2013. This means, generally speaking, that each subsequent year’s lump-sum present values since the 2014 plan year have been more costly than in its prior year. The rate increase from November 2017 to November 2018 is the first substantial increase we have seen since 2013.

Exhibit 2: Historical November 417(e) Segment Rates

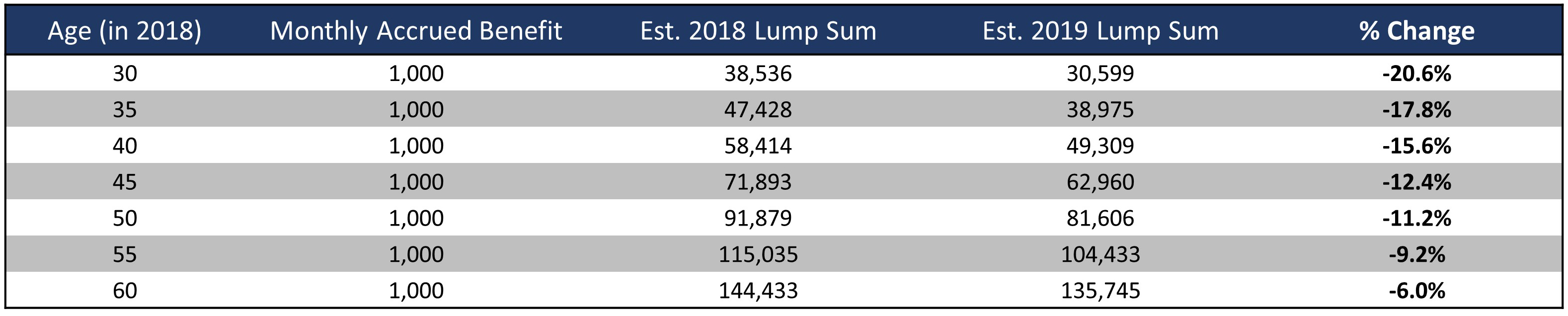

How much have lump-sum costs declined from the 2018 to 2019 plan year? To answer, let’s assume that the stability period is a year, and the lookback month is 2. We assume a normal retirement age of 65, and adjust for the population aging 1 year from 2018.

Exhibit 3 shows the result of the change in the minimum present values from 2018 to 2019 at varying ages of a $1,000 monthly accrued benefit. The overwhelming result is that lump sums payable in 2019 are less than those paid in 2018. The leading factor is the change in rates that occurred in 2018. Mortality rates were also higher in the 2019 tables than 2018, which also contributed to the decline in the present values, but they account for less than 1% of the change.

Exhibit 3. Lump sum changes from 2018 to 2019

Conclusion

In summary, lump sums in 2019 are much less costly than in 2018. Plan sponsors might even find that more participants are eligible for the $5,000 involuntary cash-outs due to this reduction. With the 2019 PBGC per-participant premium up 40% from 2015, reducing liability exposure can help long-term savings on the plan’s ongoing expenses. Overall, 2019 may be an opportune time to take advantage of lower lump-sum values.

There are also implications for managers of liability-driven investment (LDI) strategies. Plans often discover that lump-sum payouts affect the duration of their liabilities, which should prompt asset managers to adjust their portfolios accordingly. At Sage, we work as fiduciaries with our pension-plan clients to ensure that we operate with the most current actuarial data so that the LDI portfolios we manage maintain tight durations relative to liability benchmarks. That ensures that the asset allocation remains effective, even with changes to projected liabilities resulting from lump-sum payouts or any other events.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.