Bond Trauma

April 14, 2025 By Sage Advisory

There are decades where nothing happens, and then there are weeks where decades happen. Last week, the tariff stress that shocked equity markets spread across fixed income and foreign exchange markets, threatening financial stability and resulting in a delay of reciprocal tariffs from the US as well as a shift in tone from both White House officials and Fed speakers.

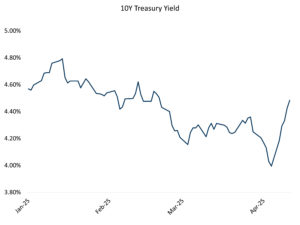

Following the tariff announcements on April 2, the chorus calling for recession grew, seeing an initial classic “flight to quality” pattern that is expected in negative economic growth shock episodes. Last week, market stress morphed into something worse, as rates traded sharply higher and the USD uncharacteristically weaker, as a system-wide deleveraging took place, particularly in leveraged positions. Falling equities, rising yields, wider spreads, and higher transaction costs are all indicative signs of a classic liquidity squeeze.

Source: Sage, Bloomberg

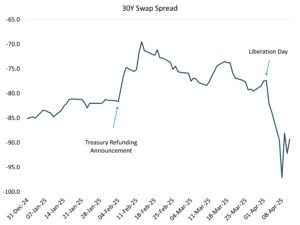

Some corners of the market displayed stress that pointed to deterioration in the functioning of the US Treasury. Swap spreads measure the difference between the interest rate on a swap and the yield on a Treasury bond with the same maturity. When the spread is wider, it means Treasury bonds are more valuable compared to swaps, and when the spread is narrower, swaps are more valuable. Since the supply and demand for Treasury bonds significantly influence these spreads, changes in swap spreads can indicate the market’s expectations for Treasury bond supply and demand.

The market had anticipated a favorable supply and demand for Treasuries following the February 5th Treasury Refunding Announcement, which led to higher spreads and leveraged investors favoring cash Treasuries over swaps. However, last week’s liquidity squeeze caused swap spreads to drop sharply. This was due to expectations of increased Treasury supply from widening deficits during a recession and a lack of buyers for Treasury debt, especially if the US aggressively reduces its trade deficit. We believe that the dysfunction in the Treasury market significantly contributed to the delay of reciprocal tariffs on April 9th. Ultimately, these disruptions should stabilize as liquidity conditions improve, particularly since Fed officials have indicated their readiness to intervene and maintain financial stability.

Source: Sage, Bloomberg

While the liquidity issues plaguing the markets can be alleviated by Fed intervention or incrementally improving headlines, the structural shift to aggressively collapse the US trade deficit with its trading partners could have wide ranging long-term implications. In particular, the aggressiveness of the tariff rollout threatens weakening the dollar’s global reserve status. After sanctions on Russia following the Ukraine invasion led to the development of a financial network outside of the US dollar system, the current tariff battle represents another phase of economic warfare. This could further encourage a shift away from dollar-based trade.

The US bond market depends heavily on foreign investors. Any significant move away from the dollar would reduce the ability to finance the US’s twin deficits (fiscal and trade). While other markets may not be as deep or liquid as the dollar-denominated bond market, there hasn’t been a compelling reason for foreign investors to look for non-dollar investment options until recently. US policymakers should be cautious not to create such a reason. It’s important to remember that capital will always flow to where there is demand.

Source: Sage, IMF, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.