Non-Financial Corporate Leverage is Increasing

As several market observers have written, corporate leverage continues to increase. Specifically, leverage, or the ratio of a company’s debt to cash flow, has increased noticeably among non-financial corporate bond issuers since 2010. Investment Grade issuers in this cohort have increased their Debt/EBITDA ratios from 2x to nearly 3x in this time frame, according to data from the St. Louis Federal Reserve (see below).

Source: St. Louis Federal Reserve

The reasons for this increase in corporate debt are manifold.

Some companies have increased their borrowings in order to accelerate stock buyback programs. Stock buybacks have become increasingly popular with corporate management teams as a way to manage earnings per share and appease activist equity holders, particularly at companies with tepid revenue growth.

Other companies have used the proceeds from large debt issuances to engage in M&A activity, often for the same purpose of ginning up top-line growth.

Regardless of the ultimate use of funds, the simplest reason why corporations have increased borrowing is also the most likely: because they can. Companies are more comfortable than ever with higher leverage and lower credit ratings because the market has not yet punished them for it. Over decade ago, only 25% of investment grade issuers carried a credit rating below “A.” Now, nearly 50% of the Bloomberg Barclay’s Corporate index is rated “BBB.” In addition, the extra spread demanded by investors for investing in BBB-rated credit vs. A-rated credit has hovered in the 40-to-70 basis point range for most of the time period following the 2008-2009 financial crisis. Many CFOs figure that paying an additional 0.50% of coupon yield for lower ratings and another turn or two of leverage is worth the gamble — if it allows them keep equity prices high, since equity returns are often correlated with management compensation.

Source: Barclay’s Capital

Strong Equity Performance Has Helped

This conflict of interest between management teams and bondholders also drives another self-fulfilling prophecy: borrowing money to help improve equity returns at the expense of credit quality leads to higher equity returns, which leads to more complacency amongst bondholders. Bondholders often look at “equity cushion” as a mitigating factor against increased leverage. They reason that if equity investors are willing to pour money into the capital structure at a level junior in priority to unsecured bondholders, then bondholders should feel relatively more comfortable with the risk of lending to the entity. The strong equity market returns of the past nine years has made the increase in leverage seem less significant to the capital structures of most companies than it actually has been.

Source: St. Louis Federal Reserve

Some Industries Have Bucked the Trend

The Banking sector is a good example of an industry that has not followed this trend of increasing leverage. After the last financial crisis, banks were forced to adopt capital buffer requirements, which have effectively lowered leverage, while the rest of the corporate bond universe has been going in the opposite direction.

A bank’s tier 1 risk-based capital ratio is a measure of liquidity and financial health. Tier 1 capital is a bank’s equity capital and core reserves. The ratio is calculated by dividing tier 1 capital by total risk-weighted assets. While major banks are required by Basel III regulations to hold a ratio of 6% or greater, on average most large banks have ratios in the 13% range, more than double what is required by law.

Source: Bloomberg

The energy and REIT sectors have also been de-leveraging in recent quarters. REITs have been decreasing leveraging due to lower returns in the real estate industry and in anticipation of bargains in the near future.

Energy companies have benefitted from an improving price environment for oil and natural gas, as well as increased operational efficiency, which has allowed them to use free cash flow to pay down debt organically.

What Should Investors Do?

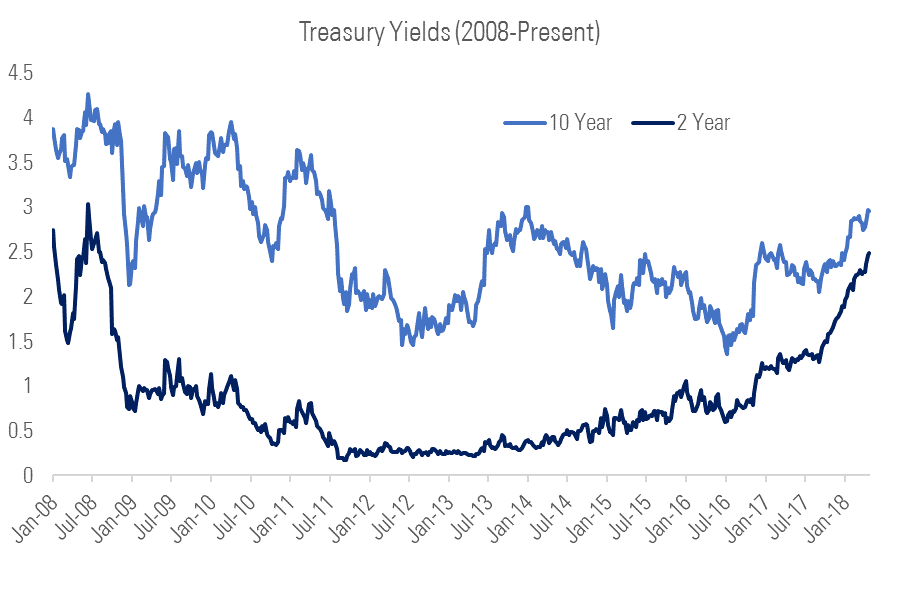

As the end of the current bullish business cycle appears to be near, bondholders should proceed with caution. The recent sell-off in risk assets has presented some opportunities and exposed risks in the corporate bond market.

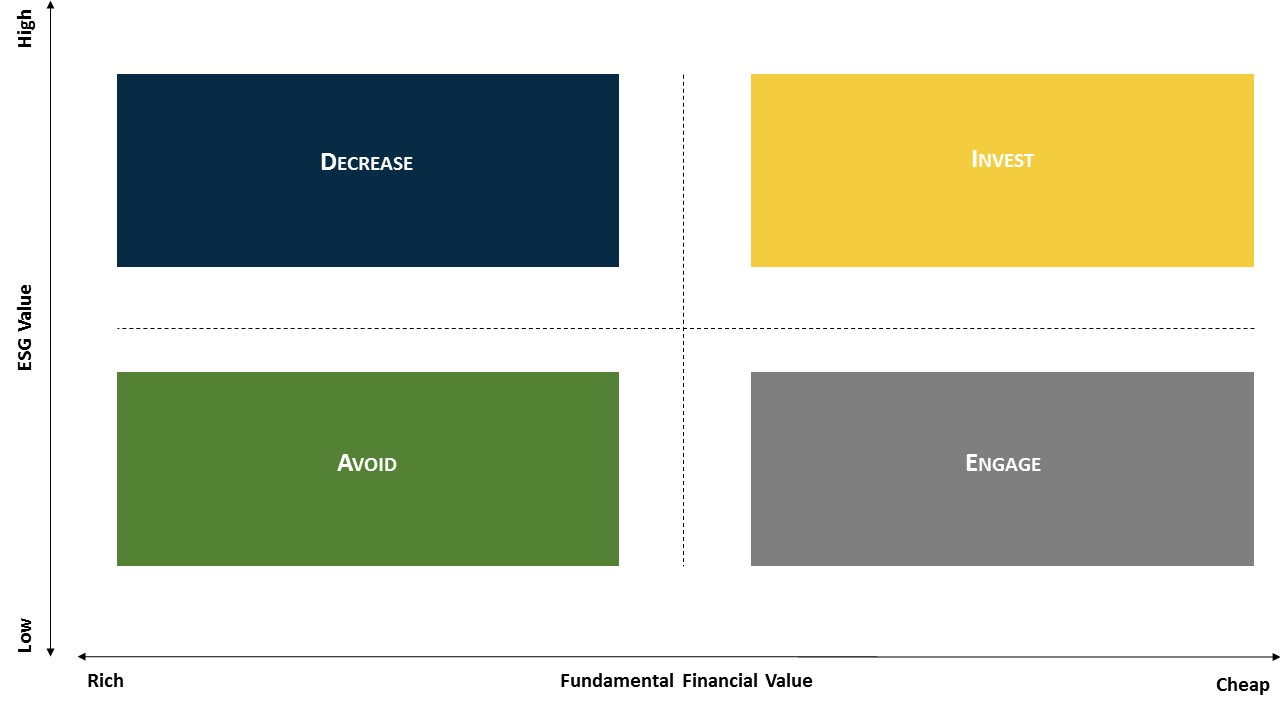

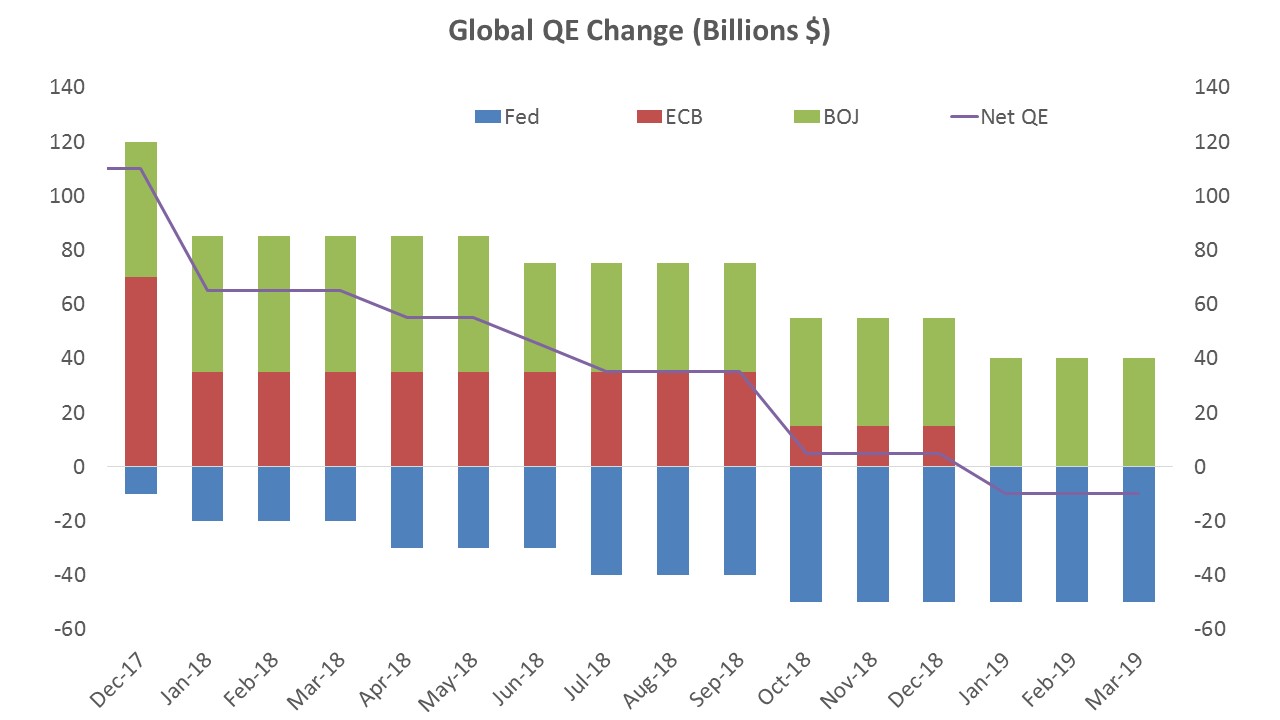

At Sage, we believe that now is the time to “sharpen the pencil” and go to work analyzing credits more closely, as dispersion in returns is likely to increase dramatically. As the large global Quantitative Easing program being orchestrated by Central Banks begins to wind down, companies that have weak financial fundamentals will see increased scrutiny from analysts and in some cases, will have trouble accessing capital markets to refinance debt. Given this possible outcome, we’ve developed a credit playbook for selecting the winners from the losers:

- Look for companies that have avoided the urge to lever up in order to engage in shareholder-friendly activities, such as stock buybacks, dividends, and frivolous M&A.

- Look for companies that have the capacity to service their own debt organically through stable or growing free cash flow.

- Avoid companies with complicated corporate structures or that have engaged in dubious M&A activity to mask declining top-line revenues at the expense of bondholders.

- Look for opportunities within sectors where fundamentals are still intact, leverage is lower, and liquidity is strong.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.