Timing is everything. For a municipal bond investor, annual seasonal trends can provide great entry and exit points, if executed properly. There are four distinct seasonal periods that occur annually due to structural factors inherent in the municipal bond market. If timed correctly, municipal investors can increase their probability of successfully trading these markets and reap the reward of better returns.

The four seasonal periods that affect the municipal market on an annual basis are January Reinvestment, Tax Season, June/July Redemptions, and the Holiday Season Slowdown.

January Reinvestment

Although not the heaviest period of bond maturity and coupon payments, January 1st does experience an elevated level of cash that needs to be reinvested. In addition, the lingering effects of the Holiday Season Slowdown contribute to a limited amount of new issue supply, as well as diminished levels of secondary supply offered by broker/dealers. This strong technical environment tends to last anywhere from a few weeks to well into February, depending on the direction and magnitude of market flows. For investors who can time liquidity needs, January represents one of the most advantageous times of year to raise funds.

Tax Season – late March through April

From late March until the end of April, the municipal bond market tends to see both a reduction in demand as well as a heightened level of selling to fund tax payments. (Selling tax-exempt municipal bonds to fund personal federal and state tax liabilities remains one of life’s great mysteries.) Regardless, tax season provides an attractive entry point for investors, as limited demand and improving new issue supply tend to push valuations to more attractive levels.

June/July Redemptions

The heaviest period of maturing bonds and coupon payments is during these two months and represents anywhere from 40% to 60% of annual redemptions. Typically, municipal issuers come to market during this time, which offsets the demand pressure from reinvestment. Unfortunately, over the past several years, municipalities have been paying down debt and reducing debt issuance, which has created a net negative supply environment. As long as new issuance remains below the long-term averages, municipal bonds will remain supportive during June and July and provide investors an opportune time to rebalance portfolios (such as reducing credit risk).

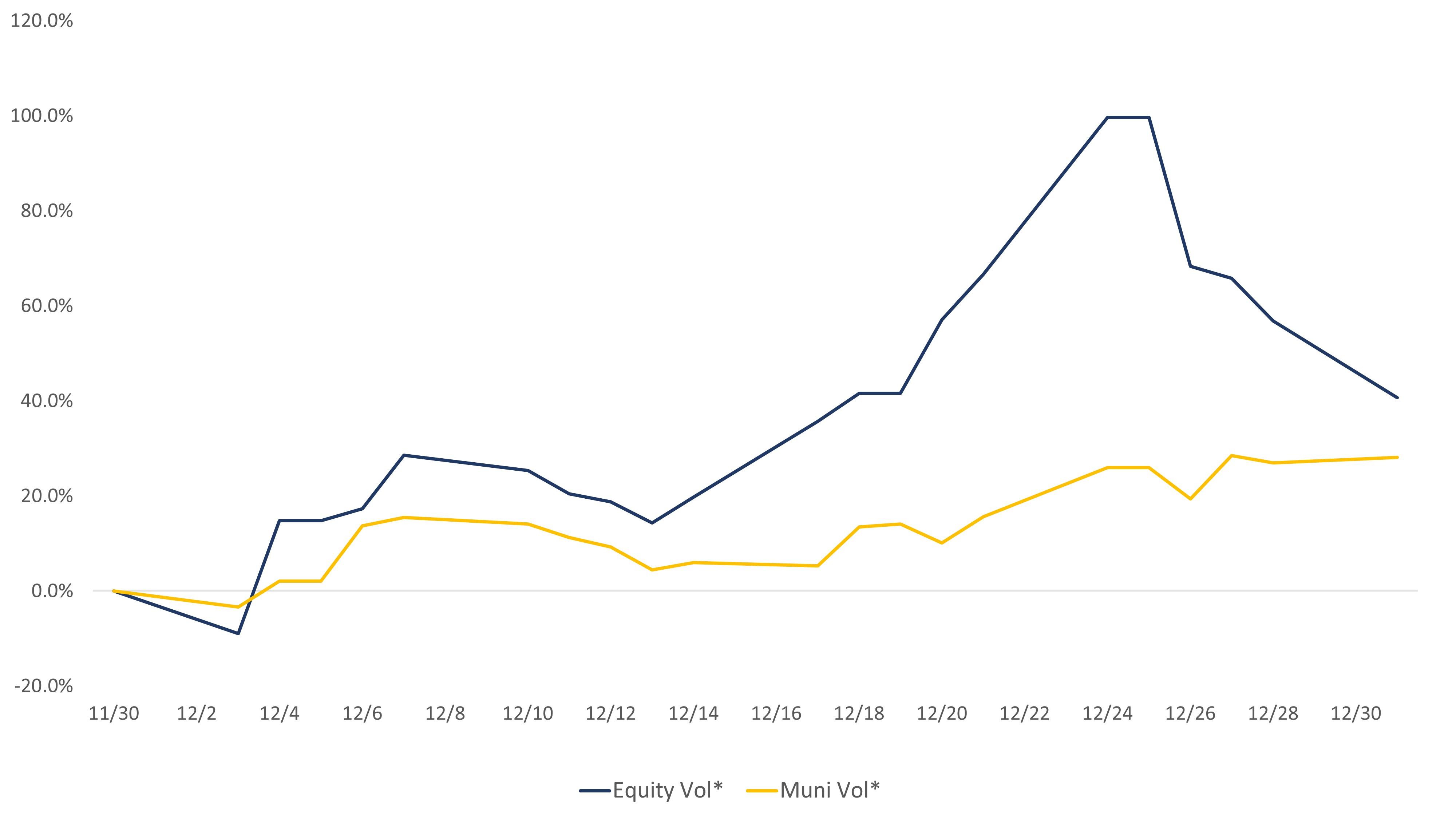

Holiday Season – late November through year-end

Thanksgiving should indicate a warning sign to investors regarding optimal liquidity and ample supply. During the week of Thanksgiving, the markets may be open; however, the focus of the market is limited. The last week of November and the first two weeks of December represent the final opportunity for investors to efficiently trade before the market essentially shuts down for the year. Junior traders and reduced staff remain the norm during the last two weeks of the year. Market making and risk taking are severely restricted and a noticeable liquidity premium on bonds is apparent. Fortunately, for those investors looking to put cash to work, the ability to purchase bonds from forced market sells offers the opportunity to add exposure at discounted levels.

Sage has always believed that a well-informed investor is a successful investor. Investors looking to make strategic and tactical shifts into and out of municipal bonds can enhance returns by timing seasonal effects appropriately. By combining Sage’s value-based investment strategy with seasonal timing of cash flow, investors will be able to maximize market liquidity and optimize return potential.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.