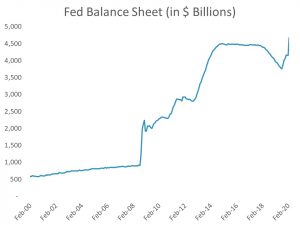

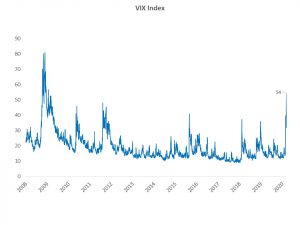

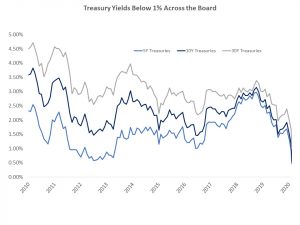

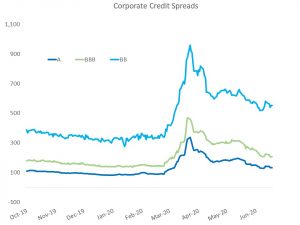

To help restore liquidity and reduce panic among investors at the depths of the coronavirus crisis, the Federal Reserve enacted several measures in late March. One such step was the implementation of a corporate bond buying program. The $750 billion facility was originally intended to only allow for purchases of bonds from companies that could attest that they were under severe stress, so few companies opted in.

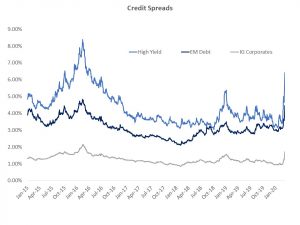

Despite the requirements of the program, credit spreads retraced most of the move wider from March, to settle in the 140 bps to 150bps range, well within the long-term average range.

And the funding costs of corporate borrowers are now actually lower than before due to a dramatic decrease in rates because of the resumption of quantitative easing. Consequently, the average coupon rates of investment grade bonds now sit at 3.89%, well below levels seen in February prior to the COVID-19 shutdowns.

With credit markets stabilized and lower funding costs for IG borrowers, bond investors have moved back into “risk on” mode.

Curiously, the Federal Reserve decided to dramatically expand the scope of its corporate bond buying program on June 15, well after markets had stabilized. The Fed indicated that the goal was to ensure corporate borrowers could access the primary markets for funding, but that goal had long since been accomplished. Why then did the Fed decide to drastically increase the size of the program by eliminating the need for companies to self-identify as “distressed?” The answer may lie in a more esoteric part of the credit markets that is typically the domain of investment bankers.

Bridge Loans

Bridge loans are typically non-public loans with shorter maturities that are designed to “bridge” the gap between an M&A event (e.g., a large acquisition) and the pricing of public bonds in the primary market that will finance the debt portion of the M&A event. These loans are usually syndicated by a small group of investment banks that each agree to provide some portion of the funds in exchange for substantial underwriting fees.

The bridge loan is used as a necessary short-term source of funding necessary to get the deal done, and typically the borrower will issue bonds a later date after a deal “roadshow” to allow public bond investors to become comfortable with the credit profile of the combined entity. In exchange for this short-term funding, borrowers will typically pay banks steep fees and higher interest rates than would be typical for such a short duration loan (usually one year or less). Consequently, this is a very profitable business for large investment banks.

The downside for the banks is the unlikely scenario where the bridge loan becomes “hung.” This refers to when a deal is agreed upon and bridge financing is secured, but between the normally short period where the bridge loan is funded and when the borrower can successfully launch a new primary bond issue the credit environment changes materially. This situation perfectly describes several large bridge loan deals that were funded with the year prior to February 2020. Without strong enthusiasm for high-yield credit risk, several of these deals would not have been able to price high-yield bonds to take out the bridge financing and the investment banks that participated in the bridge deal would be left with illiquid, stressed loans to credits that could not re-finance their short-term debt in favor of longer-dated high-yield bonds.

The following is a list of some high-profile syndicated bridge loans that would likely have ended up “hung” without help from the Fed’s liquidity infusion. These deals in aggregate account for tens of billions of dollars of credit risk for investment banks, a situation that could have easily soured the balance sheets of these banks with little recourse.

T-Mobile-Sprint

- Size: $19bn

- Structure: Covenant-light bridge loan

- Term: 364 days

- Use of Proceeds: To finance the acquisition of Sprint

- Banks Involved: Barclays, Credit Suisse, Deutsche Bank, Goldman Sachs, Morgan Stanley, RBC, US Bank, Wells Fargo, and others

El Dorado Resorts

- Size: $1.8bn

- Structure: Covenant-light bridge loan

- Term: 364 days

- Use of Proceeds: To finance the acquisition of Caesar’s Entertainment

- Banks Involved: JP Morgan, Credit Suisse, MacQuarie

Elanco Animal Health

- Size: $2.75bn

- Structure: Bridge loan

- Term: 364 days

- Use of Proceeds: To finance the acquisition of Bayer’s animal health business

- Banks Involved: Goldman Sachs

WESCO International

- Size: $3.125bn

- Structure: Unsecured bridge loan

- Term: 364 days

- Use of Proceeds: To finance the acquisition of Anixter International

- Banks Involved: Barclays, US Bank

Implications for Investors

This action by the Fed should encourage investors to think more broadly in terms of risk allocations. A well-functioning high-yield bond and leveraged loan market points to a strong “risk on” environment for investors, and there are opportunities to invest in bonds that are still below intrinsic value despite the rally in credit spreads in April and May. Investors that may have been worried about an extreme liquidity crunch grinding public credit markets to a halt should take comfort in knowing the Fed seems prepared to do whatever is necessary to maintain liquidity and keep spread volatility to a minimum for the remainder of 2020.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.