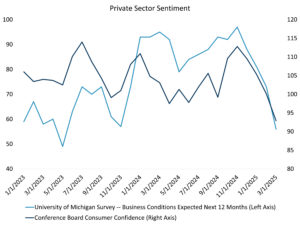

In recent weeks, market volatility has surged, driven by uncertainty surrounding the growth picture and Washington’s economic policy, particularly tariffs and budget concerns. This uncertainty has cast a shadow over the economic growth outlook, leaving the private sector grappling with unpredictability and weighing on sentiment indicators.

Source: University of Michigan, Conference Board

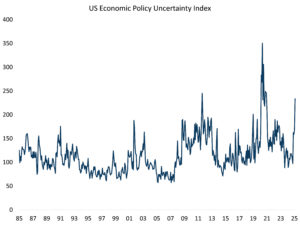

The Economic Policy Uncertainty Index (EPU) by Baker, Bloom, and Davis is a useful proxy for measuring the level of uncertainty in economic policies. The US version of the EPU is constructed from three main components: news coverage, tax code expiration data, and economic forecaster disagreement.

- News Coverage: The EPU Index analyzes search results from newspapers for terms related to economic and policy uncertainty, reflecting the frequency of articles discussing topics that include the terms “uncertain” and “economy,” as well as one of the following: “congress,” “legislation,” “white house,” “regulation,” “federal reserve,” or “deficit.”

- Tax Code Expiration Data: The index considers reports from the Congressional Budget Office (CBO) on the expiration of temporary tax code provisions, which inject uncertainty into financial planning decisions by tax-paying entities.

- Economic Forecaster Disagreement: The EPU incorporates the dispersion of forecasts for CPI and government purchases of goods and services via the Federal Reserve Bank of Philadelphia. The higher the dispersion, the higher the level of uncertainty on the economy.

The EPU Index now stands at near the highest in its history, eclipsed only by the Covid crisis period and the US ratings downgrade in 2011.

Source: ‘Measuring Economic Policy Uncertainty’ by Scott Baker, Nicholas Bloom and Steven J. Davis at www.PolicyUncertainty.com

Tariffs are injecting significant uncertainty into the inflation and demand outlook. Higher tariffs push prices higher, which is an implicit tax to consumers or companies via lower profit margins. Adding to this uncertainty is the lack of clarity on the expiration of the 2017 tax cut, including individual income tax rates, standard deductions, and the child tax credit. These expirations create significant unpredictability for taxpayers, potentially leading to higher tax liabilities and reduced benefits if the provisions are not extended or replaced. The effect of the DOGE spending cuts on the US labor market combined with the tariff and tax uncertainty has contributed to the elevated EPU Index, highlighting the challenges facing the US economy.

In this environment, investors will demand a higher risk premium to compensate for the unpredictability surrounding tariffs, tax policies, and budget concerns. The Fed has shown its inclination to adopt a more cautious stance, with the scope for policy rates to move lower if data disappoints and limited potential for rate hikes in the near term. Given the current climate of heightened economic policy uncertainty, interest rates are likely to remain biased lower.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.