Environmental, Social, and Governance (ESG)-oriented ETFs took off in 2005 with the launch of the iShares MSCI USA ESG Select ETF, with a little over $20 million in assets. It took 14 years for ESG ETF assets to reach $5 billion, and just 18 more months to get to $25 billion. What happened?

Sustainable investing has been around for decades but it was initially focused on pockets of the investment ecosystem, did not have widespread adoption, and was mainly focused on strategies that excluded areas of the markets that didn’t align with the investors’ values. It was about five years ago that large institutional investors began to consider ESG, media coverage increased, and the growth of standardized ESG data contributed to the adoption of ESG into the investment mainstream. At that time, there were two main questions with regard to ESG investing:

- First, will all the buzz around ESG result in asset flows?

- Second, by adopting a sustainable investment strategy, does the investor forgo return relative to a conventional strategy?

In this Perspectives piece, we use ETF flow and performance data from the past 12 months to give clarity on flows into ESG investments, which have gained steam in 2020 and could be foreshadowing a tipping point for flows into ESG strategies. As an example, while ESG-oriented ETFs represent only 0.8% of the $6 trillion of U.S.-listed equity ETFs, they have accounted for over 30% of ETF inflows thus far in 2020!

We also highlight performance – an ESG strategy does not result in inferior returns versus a conventional index. In fact, over the past 12 months – in which we’ve seen equities make all-time highs as well as the fastest bear market in history — ESG strategies have largely outperformed the most popular conventional passive ETFs.

Ultimately, we believe the acceleration in flows into ESG ETF assets are a result of three factors: first, the continued trend toward values-based investing, which has been spurred further by the COVID-19 and oil crises this year. Second, the breadth of investment options has reached critical mass – the average investor now can access most public asset classes through ETFs. Lastly, investors have been able to observe the performance of ESG ETFs through historic bear and bull markets in the last three years alone, and the returns so far have been favorable to ESG strategies relative to conventional passive indexes and ETFs.

Fund Flows – The Hype is Real

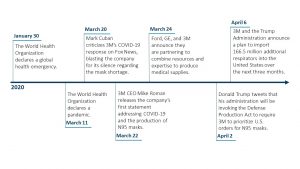

The inflow of funds into ESG ETFs, primarily in equities, has picked up steam in the past 12 months to an AUM base of $25.2 billion as of April 30, 2020. Just to put that into perspective, it took ESG ETFs a little under two years to go from zero to $1 billion in assets, 12 more years to reach $5 billion in assets, and then just 18 months to reach a $25 billion AUM mark! The chart below shows the growth of ESG ETF assets over time.

The recent wave of asset flows has been concentrated in equities, which account for the bulk of the ETF equity flows thus far in 2020. The table below shows flows of ESG ETFs versus the larger ETF universe in both equities and fixed income. While ESG Equity ETFs represent 0.8% of total equity ETF assets, they have accounted for over 30% of all equity ETF flows thus far in 2020!

The ESG fixed income space tells a different story. In 2020, fixed income ESG ETF inflows have remained modest. We believe that the slower adoption of fixed income relative to equity ETFs is to be expected as the ETF market in fixed income is smaller in terms of assets and the number of ETFs. However, as ESG investing continues to pick up steam as we have seen in equities, we believe that most asset classes and fund types should benefit from this trend.

ESG Performance – Through Thick and Thin

Investors now have enough of a sample size to judge how ESG-oriented strategies perform in both euphoric bull markets and deep bear markets. The past three years in markets have alternated between a low volatility rally in 2017, a sharp drawdown in the fourth quarter of 2018, one of the best years for equity markets in 2019, and the fastest bear market in history in 1Q 2020 during the COVID-19 crisis. It truly has been an interesting “laboratory environment” for an investment strategy, and ESG thus far has shown robustness across different market environments.

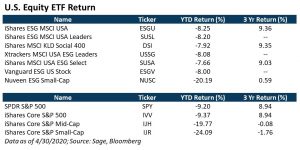

In the tables below, we examine performance of the largest segment of ESG ETF assets, U.S. equities, versus the largest passive ETFs to gauge performance during those time periods. We found that ESG not only has kept up with conventional indexes, it has also been able to outperform, which we believe is a big reason for the recent inflows into the ESG category.

The table below displays the performance of some of the largest ESG Equity ETFs as well as the largest passive ETFs of conventional indexes in equities. On a YTD basis, the ESG ETFs have outperformed the largest S&P 500 ETFs, and even the Nuveen ESG Small Cap ETF, an ESG-oriented U.S. equity strategy, has outperformed the largest U.S. Small Cap ETF on a YTD and three-year basis.

In observing the recent performance of ESG strategies, investors are recognizing the advantages of a company with superior sustainability characteristics. A company that implements material ESG principles is often associated with properties of a “high-quality” company as defined in quantitative investing parlance: profitability, low volatility, and stable earnings. These properties of companies are rewarded by markets over time, especially during late-cycle environments and recessionary time periods.

A Sign of Things to Come – Growth Opportunities

In his bestselling book The Tipping Point, author Malcolm Gladwell defines a tipping point of a social trend as the following:

The tipping point is that magic moment when an idea, trend, or social behavior crosses a threshold, tips, and spreads like wildfire.

The discussion, anticipation, and importance of ESG over the past five years has seen a follow through in asset flows, and like many of the examples in Gladwell’s book, once a concept crosses the “threshold,” change happens rapidly, not gradually.

Sage is fully committed to the growth of ESG. We provide investors with ESG ETF models, an ESG corporate bond ETF (GUDB), and ESG fixed income strategies. As ESG remains a small fraction of the ETF and separate account markets, we see the most potential for growth in two main areas. First, ESG fixed income strategies, which are picking up flows but not to the scale of equity strategies, could see the same growth trajectory as equity ETF assets as fixed income funds continue to build a track record. Additionally, there is room for growth for ESG ETFs within the defined contribution space, where there is a dearth of ESG options in most 401(k) plans. With the millennial generation now becoming the largest investment cohort, the 401(k) choice architecture should evolve with the demographics and include more ESG strategies.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.